Texas Supreme Court Extends Emergency Order On Evictions

COLLEGE STATION – The Texas Supreme Court has extended its emergency order on eviction proceedings until Sept. 30, 2020.

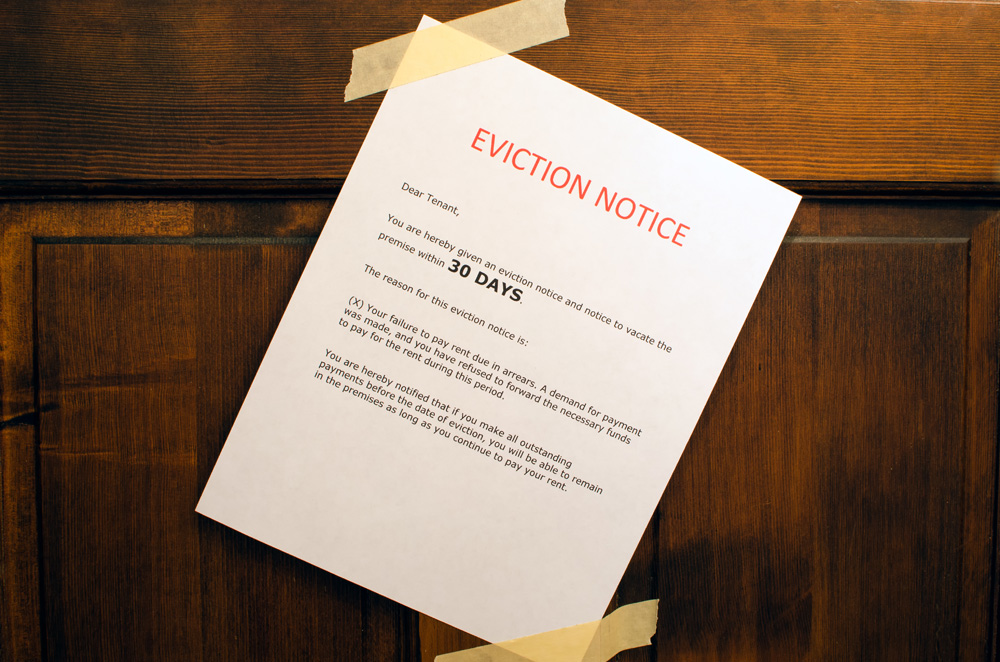

Under the order, which was originally in effect until Aug. 24, 2020, all sworn petitions for eviction must include the following statements:

-

whether or not the premises is a “covered dwelling” subject to Section 4024 of the CARES Act;

-

whether or not the plaintiff is a “multifamily borrower” under forbearance subject to Section 4023 of the CARES Act; and

-

whether or not the plaintiff has provided the defendant with 30 days’ notice to vacate under Sections 4024(c) and 4023(e) of the CARES Act.

The CARES Act is a federal law passed in response to the COVID-19 pandemic. Section 4024 of the CARES Act places a temporary moratorium on evictions with respect to certain dwelling units assisted by federal loan programs, including Community Development Block Grant loans (CDBG) (including Section 108 guaranteed loans), Neighborhood Stabilization Program loans (NSP), and CDBG-Disaster Recovery loans (CDBG-DR). Section 4023 provides protection for owners and tenants of certain multifamily properties with federally backed loans.

Source: Texas Real Estate Center

I wonder if the courts are examining the finances to ensure the tenants are failing to pay due to lack of funds and not just going to blowing the “extra cash” on stuff. The moral hazard of this program is through the roof. It can be argued to be blatantly unconstitutional since it seeks to invalidate contracts executed among competent adults.

We went through this in 2008 when people just squatted in homes for months as the banks waited for the foreclosure paperwork to get processed. In doing so, they traded their houses for cars. Made no sense then. Failing to learn from that lesson and allowing government to enable that behavior again is shameful.

Actually… I wonder if this encourages landlords to boot dead-beat tenants. I need cash flow. The penalties and interest are still accruing. My loan hasn’t stopped. I request forbearance. I cannot boot the tenant. I’m at a net loss and my credit rating (ability to grow the business) is disappearing. So take out a short term loan to get out of forbearance. Immediately boot the tenant and scramble to get a new tenant in as quickly as possible. Potentially taking even a reduced rental payment to get the money flowing again. … Hmm. Seems like

If each forbearance approval only lasts 90 days, that means we are about to enter the 3rd cycle. This could become a reality. Hope those tenants were saving. They could be homeless pretty quick.