April Report: Texas border economy summary

.

.

By Luis B. Torres, Wesley Miller, Paige Silva, and Jacob Straus

COLLEGE STATION – Economic recovery along the Texas-Mexico border slowed during April as hiring moderated. Only McAllen’s payrolls expanded after sluggish first-quarter growth.

Unemployment declined across the southern region, but the size of the local labor forces also decreased. Construction values picked up, although not to levels reached during the second half of 2020.

On the bright side, Mexican maquiladora and manufacturing employment increased during the first quarter, while total trade values stabilized at pre-pandemic levels in all border hubs except El Paso.

Housing sales, however, contracted for the third consecutive month in an environment of dwindling inventory and unprecedented median price growth. Depleted supply and accelerating home prices threaten housing affordability and are major headwinds to the region’s housing market.

Economy

The border economies remained on the path to recovery as indicated by the Dallas Fed’s Business-Cycle Indexes. Labor-market improvements in McAllen pushed the index up 2.3 percent on a seasonally adjusted annualized rate (SAAR) in April after ending the first quarter on a soft note.

The El Paso and Brownsville metric accelerated 5.2 and 4.5 percent, respectively. Economic activity slowed in Laredo as payrolls contracted, but the index still inched up 2.8 percent.

The U.S.’ ban on nonessential travel, which prohibits Mexican tourists from entering the U.S., may be restricting leisure/hospitality employment and retail sales, a component of the business-cycle indexes. These measures have been extended through July 21, 2021.

Border nonfarm employment regained 1,400 jobs in April yet increased just 1.6 percent SAAR, well below the pre-pandemic long-term average rate.

Hiring was concentrated in McAllen where payrolls expanded by 1,800 positions, largely within the leisure/hospitality, local government, and financial activities sectors.

On the other hand, employment in Brownsville and El Paso flattened as leisure/hospitality gains were offset by education/health services declines in the former and transportation/utilities and government contractions in the latter.

Laredo posted an outright loss of 400 jobs after a strong first quarter with transportation/utilities accounting for most of the monthly layoffs.

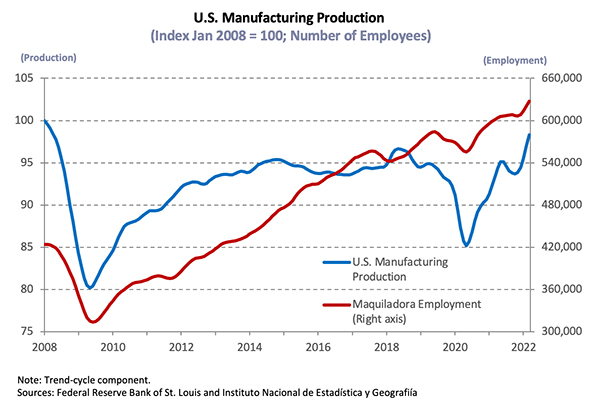

On the southern side of the border, Mexican manufacturing and maquiladora employment1 added 1,600 workers in March, elevating 1.6 percent quarter over quarter (QOQ). Hiring was most robust in Reynosa, where payrolls expanded for the ninth straight month to a record high, registering a 4.3 percent QOQ increase.

Monthly contractions in Chihuahua City and Juarez resulted in slower quarterly growth, but employment still rose 2.0 and 1.3 percent, respectively. On the other hand, Nuevo Laredo’s maquiladora and manufacturing employment ticked up just 0.9 percent QOQ, while the metric in Matamoros decreased 1.2 percent.

Revised U.S. manufacturing production data revealed output flattened in April as supply-chain disruptions continue to prevent activity from rebounding to pre-pandemic levels.

The IHS Markit Mexico Manufacturing Purchasing Managers’ Index stayed in contraction territory, albeit at its slowest rate since before the pandemic. Some companies noted stronger demand, but ongoing COVID-related business restrictions and limited availability of raw materials hindered the recovery.

The pandemic and the federal government’s response to the virus remain significant factors concerning the country’s future growth, where Texas’ border economies have strong ties.

Even though hiring stalled in Laredo and El Paso, the unemployment rates fell to 7.4 and 7.7 percent, respectively, possibly due to discouraged job seekers leaving the local labor forces.

Brownsville’s jobless rate was unchanged at 9.8 percent, but McAllen’s metric ticked down to 11.4 percent.

On the bright side, weekly initial unemployment claims declined across the border metros after rising unexpectedly during the previous month as the number of new COVID-19 cases steadily decreased (see figure).

.

.

Annual fluctuations in average private hourly earnings revealed lackluster wage growth along the border. Some of the downward pricing pressure may due to the recovery of lower-paying jobs that bore the brunt of the layoffs last spring, pulling the average wage down.

McAllen’s real hourly wages fell year over year (YOY) for the eighth consecutive month, plummeting 12 percent after adjusting for inflation to $18.98 on average.

The metrics in Brownsville ($16.66) and El Paso ($19.52) sank below year-end levels after falling 4.8 and 6.1 percent, respectively, in real terms. Real earnings in Laredo ($17.95) dropped 8.8 percent.

Total construction values improved in April after a first-quarter slowdown but remained a fifth below the average during 2020 when activity accelerated during the second half of the year.

Nonresidential construction accounted for most of the monthly improvement with widespread increases in office values and elevated school construction in Laredo and McAllen, offsetting decreased warehouse investment in El Paso.

On the residential side, apartment values rose in El Paso. The single-family sector, however, posted declines in all the metros except Laredo, contributing to an overall downward trend.

In the currency market, the peso per dollar exchange rate inched down to 20.04, but the inflation-adjusted rate2 elevated 8.1 percent above pre-pandemic levels, revealing that domestic goods were still relatively costly to Mexican buyers.

Nevertheless, total trade values passing through the border hubs stabilized at pre-pandemic levels. The exception was El Paso, where activity continued to register less than one-third of values before the crisis.

Ongoing supply-chain disruptions, particularly surrounding products that contain semiconductors, contributed to much of the lagged recovery. The border’s trade sector remains an integral component of the local economies.

Housing

While mortgage interest rates were still relatively low, they hovered at a nine-month high in April as border housing sales decreased for the third consecutive month in April, falling 3.4 percent. Transactions for higher-priced homes rose across the border metros, but reduced activity at the bottom cohorts amid constrained inventory pulled overall sales down.

The metric in McAllen and El Paso declined 9.3 and 3.3 percent, respectively, and flattened in Brownsville. Laredo sales increased 3.3 percent although the overall metric continued to trend downward.

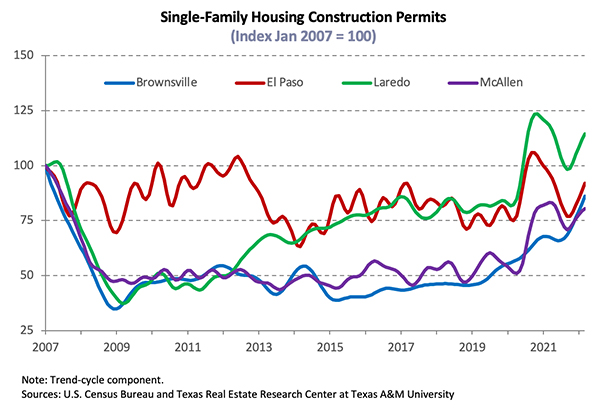

Single-family housing construction permits sank 9.5 percent, normalizing after record activity in 4Q2020. Issuance, however, still exceeded its yearlong average.

Permits in the Rio Grande Valley decreased 6.2 percent in McAllen and 2.3 percent in Brownsville but remained on an upward trajectory. Laredo and El Paso registered steeper declines as permits fell 15.8 and 10.5 percent, respectively.

Private single-family construction values reflected fluctuations in permits except for in Laredo, where values accelerated 6.1 percent. Nevertheless, the metric plummeted more than a third below year-end levels.

Although sales activity slowed in the Rio Grande Valley during April, the 12-month moving average rose and offset the two-month increase in the number of new listings added to the market. Months of inventory (MOI) fell to all-time lows of 1.4 and 2.5 months in Brownsville and McAllen, respectively.

Meanwhile, inventory in Laredo decreased to two months. El Paso’s MOI ticked up to the statewide average (1.3 months) as sales declined for the third consecutive month, but the metric sank below one month for homes priced less than $200,000.

The average number of days on market (DOM) along the border declined relative to year-ago levels, corroborating robust demand despite monthly upticks in the El Paso and McAllen metrics to 51 and 72 days, respectively, from record lows earlier this year. Meanwhile, Laredo and Brownsville shed more than two weeks off their DOMs, dropping to an unprecedented 36 days in the former and 74 days in the latter.

The ongoing shift in the composition of sales toward higher-priced homes due to limited inventories at the lower end of the market contributed to increases in the median home price.

In Brownsville, where the share of homes sold priced less than $200,000 plummeted from three-quarters a year ago to less than half in April, the metric skyrocketed above $225,900, averaging 26.3 percent annual growth year to date.

The other metros also registered double-digit home-price appreciation in the first four months of the year relative to the same period in 2020, although at less extreme rates.

The El Paso median price rose to an all-time high of $194,700, while the metric in McAllen and Laredo increased to $186,400, and $198,600, respectively.

Even if compositional changes in sales were controlled for, it is likely that the true changes in single-home values were similarly unsustainable, as demonstrated by the similar statewide acceleration in the Texas Repeat Sales Home Price Index.

____________________

1 Mexican manufacturing and maquiladora employment is generated by the Instituto Nacional de Estadística y Geografía. Its release typically lags the Texas Border Economy by one month.

2 The real peso per dollar exchange rate is inflation adjusted using the Texas Trade-Weighted Value of the Dollar. Its release typically lags the Texas Border Economy by one month.

To see the previous month’s report, click here. This story originally published by Texas Real Estate Research Center.