COVID-19 Resurgence Across Texas Depresses Economic Growth

The seven-day average of COVID-19 patients in hospitals increased to 9,269 on Dec. 16 from 3,159 on Sept. 24 but remains below the peak reached on July 22.

The latest pandemic hospital census was 90 percent of the midyear high, with the University of Texas COVID-19 Modeling Consortium median forecast anticipating a new spike in early January.

Recent Texas Economic Activity Sluggish

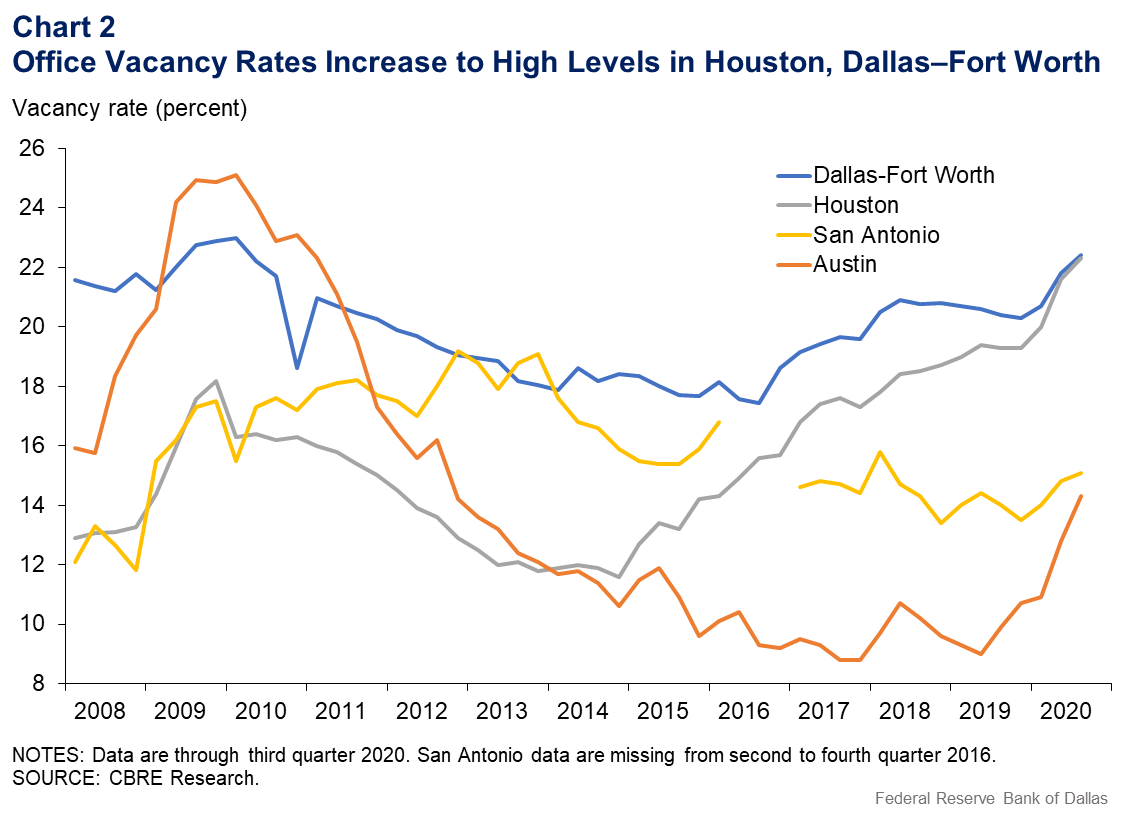

Data show a marked decline in November job growth as COVID-19 cases and hospitalizations increased sharply across the state (Chart 1).

Growth slowed in both manufacturing and services, according to the Dallas Fed’s Texas Business Outlook Surveys (TBOS). Overall, jobs grew by 40,000 in November following an increase of 105,000 in October.

Downloadable chart | Chart data

Downloadable chart | Chart data

Unsurprisingly, the recent statewide COVID-19 case rise has stalled business activity. In special questions asked in the November TBOS survey, 75 percent of contacts reported they were taking action in response to the rise in illness, with a majority stating that they were trimming operating expenses and reducing or postponing capital expenditures.

Nearly 20 percent of those reporting a response to the recent surge said they were laying off workers.

Hotels and Offices Hit Hard; Building Permits Soar

Along with the hospitality sector, the hotel industry has been hard hit by the pandemic. Occupancy rates in all major Texas metros declined markedly in the first quarter and fell to historical lows in the second quarter.

In the third quarter, occupancy recovered somewhat, although for many hotels it likely remained below breakeven.

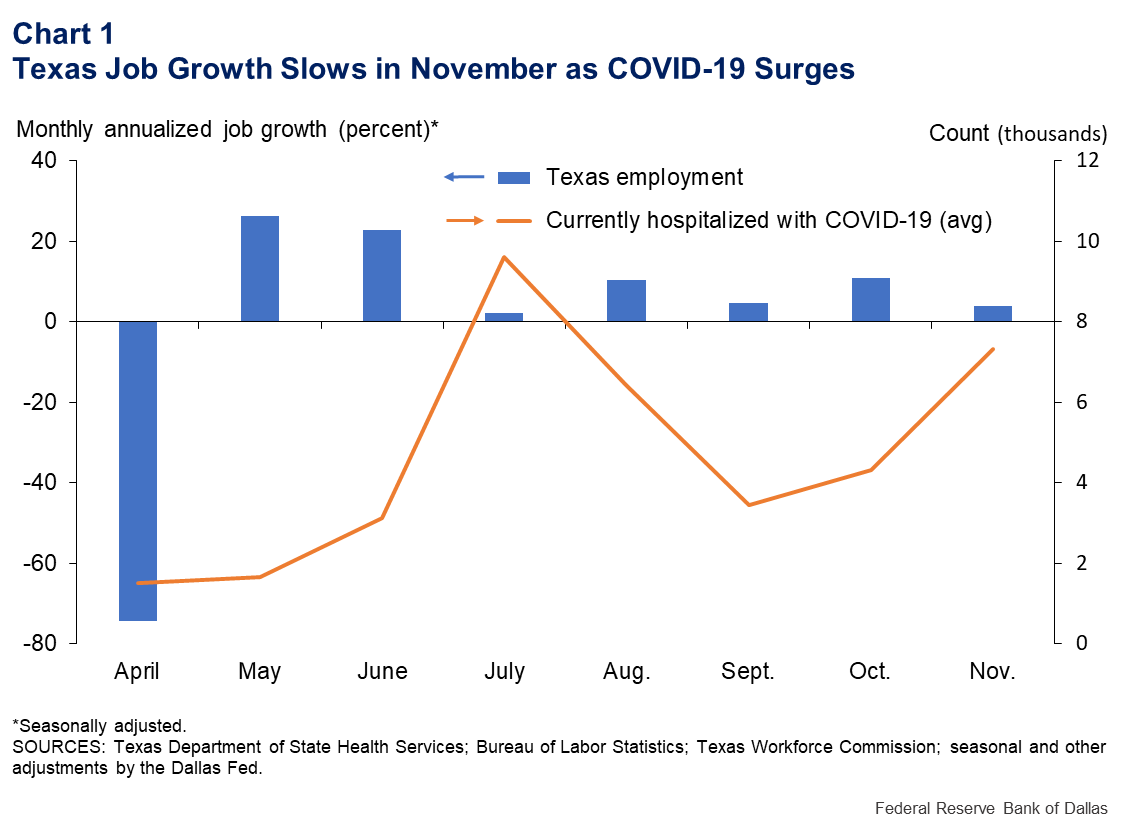

Vacancy rates for office real estate have dramatically increased in major Texas metros since the first quarter due to the deteriorating economic conditions and a rise in remote work.

As of the third quarter, office vacancy rates in Dallas–Fort Worth reached rates similar to those during the Great Recession a decade ago, while the vacancy rate in metro Houston far exceeded rates for any period since 2008 (Chart 2).

Vacancy rates were the highest since the third quarter of 2012 in Austin and since the first quarter of 2018 in San Antonio.

Residential building in the state during the first 10 months of 2020 held strong despite the pandemic. Total building permits (single family and multifamily) were 9.3 percent ahead of the same period in 2019. Indicators suggest that residential building will remain strong through at least midyear 2021.

Small Businesses, Households Still Under Stress

While small businesses were under increasing financial distress during the third quarter, loan delinquency rates remained well below Great Recession highs.

The small business delinquency rate in the Federal Reserve’s Eleventh District fell slightly to 0.62 percent in the third quarter from 0.65 percent in the second quarter—the highest level since the third quarter of 2010.

Consumer loan delinquency rates remain below 2019 levels, although many obligations are covered by some kind of forbearance at least until year-end 2020. (Some protections for credit card holders ended during the summer.) On-time rental payments for apartments are slightly down from last year.

Financial stress will likely increase sharply heading in 2021, with many workers experiencing long periods of unemployment and a number of loan protections expiring.

A congressionally approved $900 billion measure could provide some relief in the form of a one-time $600 direct payment to qualifying individuals and a $300-per-week unemployment insurance extension for 10 weeks.

Additionally, the legislation would extend to the end of January an eviction moratorium that was scheduled to expire earlier in the month and would provide $25 billion in rental assistance.

Weaker Economic Activity Expected in 2021; Vaccine Spurs Optimism

If new COVID-19 cases and hospitalizations continue increasing in the post-holiday period, demand will likely weaken in high-personal-contact industries such as sit-down restaurants, bars, and beauty salons.

Thus, weak job growth is likely over the next few months. Flat job growth is expected in December, according to the Dallas Fed’s Texas Weekly Employment Estimate.

The beginning of vaccine distribution in December is good news, with many expecting vaccinations to be available to the great majority of the population by mid-2021.

This will provide a significant stimulus to the economy as people move more freely and return to high-contact businesses and travel.

Many questions remain about more permanent disruptions caused by COVID-19. It remains unclear when business travel will return to pre-COVID-19 levels, how many employees working from home will return to the office and the pandemic’s long-term impact on brick-and-mortar retail.

We will release our official 2021 Texas forecast at an online event on Jan. 29. Currently, we expect Texas job growth will be above trend but insufficient to return to pre-COVID-19 levels by year-end 2021.

About the Authors

Phillips is an assistant vice president and senior economist in the San Antonio Branch of the Federal Reserve Bank of Dallas | Teng is a research analyst in the San Antonio Branch of the Federal Reserve Bank of Dallas.