Rural land expert: ‘Insatiable appetite’ for land, record prices, and activity that ‘defies fundamentals’

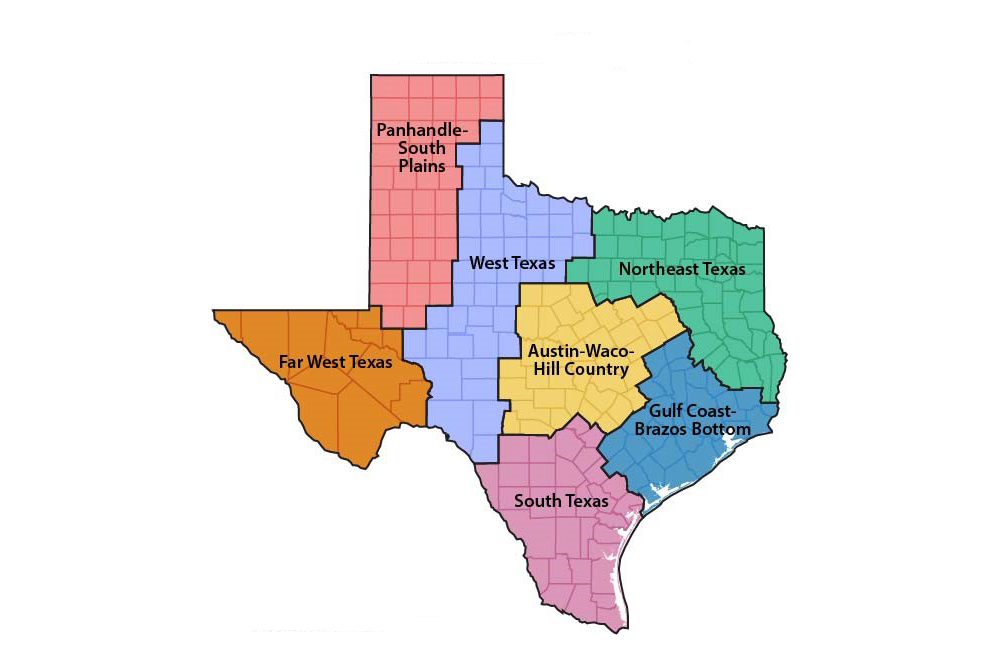

COLLEGE STATION, Tex. (Texas Real Estate Research Center) – Competition for a limited supply of land for sale pits investors, developers, and end-users against each other. In no place in Texas is this truer than in the Austin-Waco-Hill Country region (see map).

Research Economist Dr. Charles Gilliland with the Texas Real Estate Research Center (TRERC) at Texas A&M University monitors the rural land market using a network of local observers. Here’s his second-quarter, region-by-region recap of their commentary.

.

Austin-Waco-Hill Country: ‘Take a Number’

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$5,290 |

|

Percentage price change |

30.01 |

|

Number of sales |

2,785 |

|

Percentage number change |

35.72 |

|

Total acres sold |

160,386 |

|

Percentage acreage change |

58.73 |

“If you want property in this region, take a number,” said Gilliland. “Brokers have buyers lined up.”

Strong demand has prompted active subdivision operations, he said, noting that National Land Partners has acquired more than 8,000 acres in various locations, breaking them into ten-acre tracts.

“U.S. buyers are coming from as far away as Alaska and as near as Austin, Houston, and Dallas,” said Gilliland. “Meanwhile, investors from India have an insatiable appetite for land near the City of Austin and Williamson County. In many cases, these buyers make offers that exceed asking prices.”

Small properties sell within days of listing, he said. The frenzied demand includes both cropland and rangeland.

“The region’s suburban market is strong as well,” said the TRERC economist. “Investor activity in eastern Williamson County into Milam County defies fundamentals as investors have run up prices. This has propelled asking prices to record-high levels.

“Much land has transferred to non-end users, such as investors and speculators. Industrial land in Williamson County has tripled in price overnight. All markets are still escalating.”

Gilliland quoted a seller as saying, “I would sell everything I have, but I don’t know what to do with the money.”

In ranch markets farther from Austin, current pricing is testing the top of the market. Some ranch sales have failed. Typical buyers are wealthy individuals worried about inflation.

.

Panhandle, South Plains: ‘Record High Price’

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$1,231 |

|

Percentage price change |

9.81 |

|

Number of sales |

522 |

|

Percentage number change |

20.55 |

|

Total acres sold |

149,403 |

|

Percentage acreage change |

137.97 |

“With buyers, mostly farmers, flush with cash from both government stimulus payments and strong commodity prices, sales increased dramatically in the second quarter,” said Gilliland. “Regional sales this year will exceed those of 2016, the previous record-holder. Observers expect the high level of activity to continue with record-high land prices in the offing.”

Abundant water in Hutchinson, Moore, and Sherman Counties prompted dairies to acquire land to provide feed for their operations. In addition, farmers are harvesting good crops selling at high prices.

“Larger transactions have taken a pause, although there was active bidding on the 6666 Ranch in Guthrie. The market for properties priced at $20 million and up may be softening, but smaller sales are still hot,” said Gilliland.

He added that worries about inflation and tax law change motivated many buyers and sellers. Cropland sales slowed, but prices are steady or increasing. Current high prices have prompted more owners to offer land for sale.

.

Far West Texas: ‘Unrealistic Asking Prices’

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$1,608 |

|

Percentage price change |

171.62 |

|

Number of sales |

21 |

|

Percentage number change |

-14.38 |

|

Total acres sold |

25,068 |

|

Percentage acreage change |

-44.03 |

“Oil and gas woes have dried up demand for large ranches in this region,” said Gilliland. “However, with oil prices climbing, oil companies’ activities are increasing.”

Although observers report an oversupply of land for sale at unrealistically high asking prices, he said, the latest transactions have been around $1,500 per acre.

“Buyers pay cash in most deals, and there is a lot of subdivision activity and residential development. Market participants are worried about changes in tax laws.”

.

West Texas: ‘Activity Exploded’

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$1,887 |

|

Percentage price change |

12.32 |

|

Number of sales |

1,190 |

|

Percentage number change |

60.38 |

|

Total acres sold |

223,769 |

|

Percentage acreage change |

139.00 |

“Activity exploded in West Texas as buyers snapped up small, medium, and large properties,” said Gilliland. “Many subdivided the large properties, quickly selling the smaller tracts.”

Observers expect higher prices in the near future, he said.

.

Northeast Texas: ‘Waves of Demand’

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$6,294 |

|

Percentage price change |

27.87 |

|

Number of sales |

2,750 |

|

Percentage number change |

30.64 |

|

Total acres sold |

99,628 |

|

Percentage acreage change |

34.94 |

“Waves of demand in the Dallas-Fort Worth Metroplex meant strong activity in the region,” said Gilliland. “Buyers eagerly purchased any properties for sale. Many of those buyers were investors, with a number of them subdividing large acquisitions and selling smaller tracts.

Because of a dearth of properties for sale, Gilliland said some markets had few sales. Observers anticipate an uptick in cropland sales.

“Sawtimber prices have increased 45 percent over the last year, while pulp wood prices have remained steady,” said Gilliland. “Houston buyers have increasingly targeted land in Polk County. Sellers of $200,000-$250,000 properties frequently receive multiple offers.”

.

Gulf Coast-Brazos Bottom: ‘Dramatic Activity’

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$7,794 |

|

Percentage price change |

17.56 |

|

Number of sales |

1,226 |

|

Percentage number change |

55.39 |

|

Total acres sold |

48,681 |

|

Percentage acreage change |

34.97 |

“Demand from the urban centers drove Coastal Bend land markets as buyers prepared for growth,” said the Center economist.

Progress on the “Aggie Expressway” from Houston toward College Station spurred dramatic activity in Grimes County as investors anticipated future development.

“Short supplies of listings restricted sales activity in some areas,” he said. “Observers noted an increasing number of out-of-state buyers. Overall, strong demand should cause prices to increase in the future.”

.

South Texas: Divided, Sold

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$4,595 |

|

Percentage price change |

19.20 |

|

Number of sales |

837 |

|

Percentage number change |

63.16 |

|

Total acres sold |

89,957 |

|

Percentage acreage change |

109.60 |

South Texas activity was marked by large properties, which were subdivided and quickly sold as smaller parcels. Duval and Live Oak Counties were especially active.

.

Texas Totals

|

Third Quarter Annualized Land Sales |

|

|

Price per acre |

$3,717 |

|

Percentage price change |

24.94 |

|

Number of sales |

9,331 |

|

Percentage number change |

40.13 |

|

Total acres sold |

796,892 |

|

Percentage acreage change |

75.12 |

Source: Texas Real Estate Research Center