Tax Cuts And Jobs Act: A First Look At The Mortgage Interest Deduction

The recently released “Tax Cuts and Jobs Act” affects a wide array of industries, none more so than residential real estate. Changes to the mortgage interest deduction is…

The recently released “Tax Cuts and Jobs Act” affects a wide array of industries, none more so than residential real estate.

Changes to the mortgage interest deduction is drawing significant attention across the country. The proposal decreases the cap on newly issued loans from $1 million currently to $500,000, while removing any deductions on second homes.

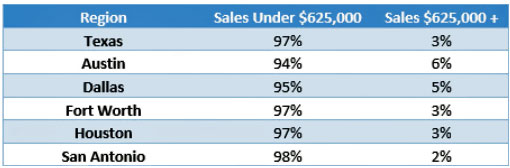

Assuming a 20 percent down payment, homes selling for $625,000 would be the maximum price that allows the deduction of all mortgage interest.

The plan also establishes a $10,000 limit on state and local property taxes, which is particularly relevant to the Texas tax structure.

In return, the legislation roughly doubles the standard deduction for individuals from $6,350 to $12,000 and from $12,700 to $24,000 for married couples filing jointly.

Here are a few facts to keep in mind as the debate wages on.

Percent of Texas home sales under and over $650,000

This article was originally published by Real Estate Center at Texas A&M University