Texas Housing Insight – October 2017 Summary

Short-term home price appreciation relaxed in Central Texas. But it’s likely a temporary pause. Rising home prices continued to outpace…

![]()

October 2017 Summary

The Texas housing market continued to recover from the August hurricane shock. Housing sales expanded across the state despite shortages of homes priced under $300,000. Leading supply indicators rebounded but remained below 2007 levels.

Housing demand remained robust, particularly for existing homes as buyers search for affordable housing. Short-term home price appreciation relaxed in Central Texas. But it’s likely a temporary pause. Rising home prices continued to outpace Texas wage growth, augmenting affordability concerns.

Supply*

The Texas Residential Construction Cycle (Coincident) Index, which measures current construction activity, flattened as falling residential construction values offset gains in construction employment.

However, rebounding weighted building permits and housing starts accelerated the Texas Residential Construction Leading Index (RCLI) for the first time since March, signaling increased residential construction activity in the next coming months.

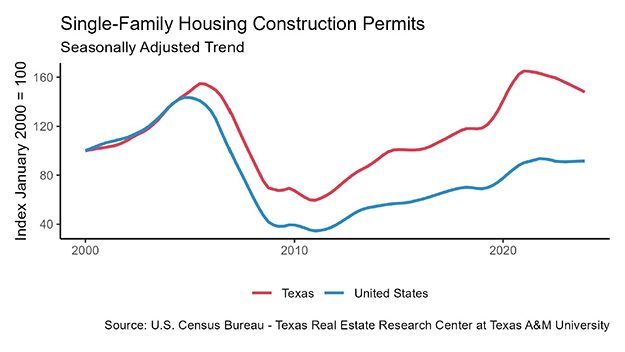

Texas single-family housing construction permits (unweighted) ticked up slightly but remained 13.9 percent lower than pre-recession levels. Houston posted double-digit growth for the second consecutive month, issuing a nation-high 3,344 permits nonseasonally adjusted (NSA), as the disaster recovery process continued.

The Dallas-Fort Worth Metropolitan Statistical Area (MSA) ranked second with 2,484 permits but flattened as Fort Worth permits slid for the second straight month. Dallas remained the only major metro where per capita permits recovered fully from the Great Recession.

Monthly permits in Austin dropped below 1,200 but maintained 5.1 percent year-over-year (YOY) growth. San Antonio permit growth calmed after surging 36.6 percent between April and September.

Stagnant single-family private construction values, which closely track permits, illustrated suppliers’ current shortfall in satisfying housing demand. In Texas, single-family construction values stagnated on a three-month moving average (3MMA), continuing its three-year flat trend.

A six-month slide in Dallas offset increases in Austin and San Antonio at 5.7 and 3.5 percent (3MMA), respectively. Houston single-family construction values were sluggish despite rebuilding efforts. The recovery process is expected to last several months and stimulate the construction industry.

Total Texas housing starts rebounded 16.3 percent after falling in the second and third quarters. Multifamily construction accelerated after months of adjustment to oversupply, while persistent demand elevated single-family homebuilding. Builders struggled to satisfy demand amid rising costs and skilled-labor shortages.

Marginal growth in supply factors has not kept pace with housing demand, thereby magnifying market imbalances. Consequently, the Texas months of inventory (MOI) dropped below 3.7 months; around six months is considered a balanced housing market.

The MOI remained particularly constrained for homes priced under $200,000 and between $200,000-$300,000, settling at 3.0 and 3.2 months, respectively. These lower price cohorts accounted for more than 70 percent of homes sold through a Multiple Listing Service (MLS), and their minimal inventories illustrate the supply challenges facing affordable housing.

Tight inventories were prevalent in the existing home market, where homes are generally less expensive than newly constructed equivalents.

The Texas MOI for existing homes fell below 3.4 months, declining in every major MSA. Resale inventories contracted for the fourth consecutive month in Houston, pulling the MOI below the statewide level—a trend that began prior to Hurricane Harvey.

Fort Worth, Dallas, and Austin maintained exceptionally low inventories at 1.9, 2.1, and 2.1 months, respectively. In San Antonio, the MOI dropped below 3.2 months after four months of positive increases.

New home inventories also declined but maintained solid year-to-date (YTD) growth. The Texas new home MOI fell below 5.2 months after reaching a six-year high in August.

The MOI in Austin, Dallas, and San Antonio hovered around 4.7 months but have displayed varying trends. Austin and San Antonio maintained 15.4 and 5.7 percent YTD growth but have declined steadily since June.

In contrast, the Dallas MOI trended upward, reaching its highest level since 2011. The Houston MOI, which is historically higher than the other MSAs, settled just above the statewide level at 5.3 months.

Overall, this year’s new home inventory expansion decelerated, heightening supply pressures in the resale market.

Demand

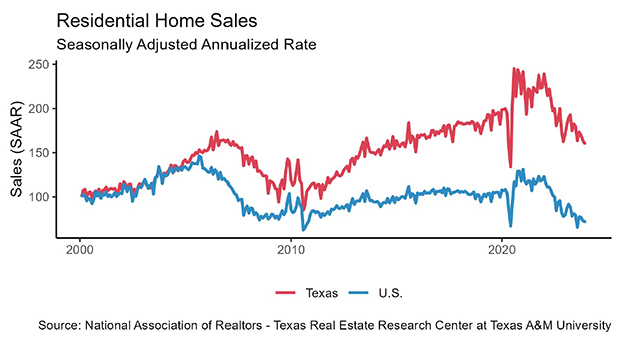

Texas seasonally adjusted housing sales rose 4 percent amid modest growth across the state.

Houston’s rebound after Harvey held steady as sales increased 7 percent YOY, accounting for nearly a quarter of the statewide growth.

Sales in Austin, Fort Worth, and San Antonio increased more than 4 percent YOY, while Dallas posted 3.4 percent YOY growth.

Led by the Houston recovery, statewide sales increased in every price cohort. Sales expanded 4.6 percent on homes between $200,000-$300,000, pushing YOY growth into double digits.

Sales increased 3.9 percent on homes priced under $200,000 but remained negative YOY. Sales growth in the top price cohort (homes priced above $500,000) posted the largest monthly increase at 4.9 percent.

Texas housing demand remained robust as the average days on market (DOM) settled just under two months.

Homes priced between $200,000-$300,000 sold rapidly, averaging 54 days on the market, while homes under $200,000 averaged just over 61 days. Demand was softer for the top price cohort, where homes sold on average after 85 days.

The existing home days on market remained historically low at 54 days but has ticked up slightly since July. Demand for resale homes in the Texas Urban Triangle persisted below the state level, but the Houston and San Antonio DOM hovered nearby at 51 and 50 days, respectively.

Dallas and Fort Worth observed intense resale demand with DOM settling at 35 and 34 days, respectively. The Austin DOM balanced at 45 days, slightly above year ago levels.

New home demand was relatively soft as Texans searched for lower-price options, holding the new home DOM above 90 days. Austin maintained the highest DOM at 96 days, followed by Houston at 95.

Surprisingly, the demand for both new and existing homes in Houston showed few signs of strengthening despite approximately 38,000 residents displaced by Harvey.

New homes sold slightly faster in Dallas and San Antonio, averaging 86 and 84 days on the market, respectively, while Fort Worth homes sold after an average of 81 days.

Interest rates elevated after the U.S. Senate approved a budget resolution, opening the door for tax reform. The potential deficit increase resulting from tax breaks would expand the number of bonds issued, weighing on the price of existing debt.

If tax cuts sufficiently stimulate economic activity, it could attract investors away from bonds in favor of riskier assets. Yields received an extra boost after the release of the Federal Reserve Board minutes, indicating a high likelihood of raising the federal funds rate in December.

As a result, the ten-year U.S. Treasury bond yield bounded from a YTD low last month, reaching 2.36 percent.

The Federal Home Loan Mortgage Corporation 30-year fixed-rate also reversed its downward trend, reaching 3.9 percent after slipping in the third quarter. Despite these upticks, yields remained low by historical standards, contributing to a nationwide rebound in mortgage applications for new home purchases.

Prices

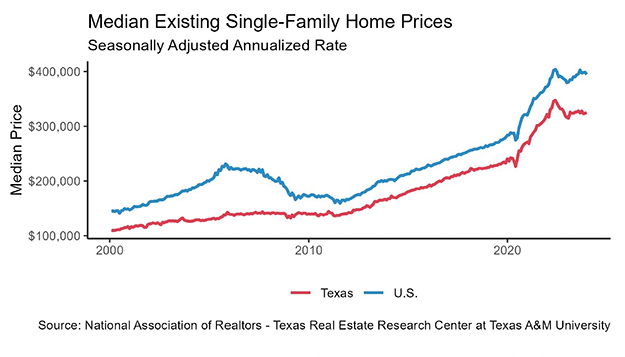

Price pressures eased in 3Q17 as the Federal Housing Finance Agency (FHFA) Housing Price Index, which tracks price changes on the same homes over time, decelerated across the state.

The Texas index slowed to 1.2 percent quarter over quarter (QOQ), the lowest rate in three years.

Similarly, the Austin and Fort Worth indices dropped to 1.1 and 1.6 percent, respectively. Houston and San Antonio home prices contracted, pulling QOQ growth below zero. Dallas was the exception, where home prices soared 2.6 percent QOQ and 10.4 percent YOY.

Texas price appreciation moderated in October as the median home priced ticked up by less than 1 percent to $225,970. Price stabilization in the resale market, where the median settled around $215,400, contributed to this month’s deceleration.

The median price for existing homes contracted in Austin ($292,243), Houston ($222,648), and San Antonio ($199,076) but remained positive YOY. In contrast, home prices pushed higher in North Texas, reaching all-time highs above $272,700 and $212,500 in Dallas and Fort Worth, respectively.

The statewide median price for new homes sold through a MLS remained flat on the year, hovering around $290,000. New home price pressures have relaxed throughout the year, reflecting builders’ move toward lower-priced developments.

Dallas maintained the highest median price at $341,810, down 1.7 percent YOY. On the other hand, the median price was lowest in San Antonio ($251,774), falling 3.4 percent YOY.

In Fort Worth and Houston, the new home median price fell to $308,851 and $301,859, respectively. The median recovered slightly in Austin up to $304,790 but remained negative YTD and YOY.

The statewide median price per square foot (ppsf) for new homes increased over ½ percent to $122.11. Rising land costs and strict regulations caused homebuilders to reduce the square footage of new homes.

The average lot size for new homes sold was 2,359 sf, 6.8 percent smaller than the peak of 2,530 sf in 2014. The statewide median ppsf for existing homes inched upward to $107.83 as lot sizes shrunk.

Austin led the state in ppsf for both new and existing homes at $140.37 and $147.27 ppsf, respectively.

However, the median ppsf in Dallas continued to converge towards Austin, rising 3.8 percent YTD for new homes and 6.8 percent YTD for resales.

The Texas sale-to-list price ratio settled at 0.96 in both the new and resale home market. New home ratios remained higher than their resale equivalents in Fort Worth and San Antonio but continued to converge to 0.97.

Houston posted the lowest ratios for new and existing homes at 0.94 and 0.95, respectively. In general, high sale-to-list price ratios across the state indicated a sellers’ market for both new and existing homes.

____________________

*All monthly measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise.

This article originally published by Real Estate Center of Texas A&M University.