August 2018: Texas Border Economy

![]() Trade values balanced around record highs, and the outlook improved following the announcement of the U.S.-Mexico-Canada Trade Agreement. The unofficial pact calms concerns of supply-chain…

Trade values balanced around record highs, and the outlook improved following the announcement of the U.S.-Mexico-Canada Trade Agreement. The unofficial pact calms concerns of supply-chain…

Economy

Recently released 2017 gross metropolitan product (GMP) data revealed mixed trends along the border. The Brownsville economy contracted 0.8 percent year over year (YOY), while El Paso’s economy inched forward just 0.3 percent. Economic output in Laredo recovered most of its 2016 losses, rebounding 1 percent YOY. McAllen’s GMP increased 1.9 percent YOY but remained below its ten-year average of 2.4 percent.

The Dallas Fed’s Business-Cycle Indices indicated contemporaneous improvements in Brownsville and El Paso. Economic activity increased 3.5 and 2.5 percent on a seasonally adjusted annualized rate in Brownsville and El Paso, respectively, well above their post-recessionary averages.

The McAllen index remained in positive territory, but soft employment growth weighed on the local economy. In Laredo, job losses and sliding wages led to the 11th consecutive business-cycle contraction, but trade activity remained elevated.

Total border construction values increased for the third consecutive month, rising 12.4 percent as momentum continued in the nonresidential sector. Ongoing school construction in El Paso and McAllen supported most of the increase, but Brownsville and Laredo had upticks in retail and hospital construction.

After a second-quarter boom, McAllen residential construction values dropped 0.6 percent as single-family housing activity fell to more typical levels. Apartment projects in Brownsville and El Paso supported growth in the multifamily housing sector.

Border nonfarm employment decelerated to 1.2 percent SAAR, adding just 500 jobs1 in August. All metros had a slowdown except El Paso, which balanced at 0.8 percent growth. Brownsville’s employment growth decelerated to 2.1 percent as the leisure and hospitality sector shed nearly 1,000 jobs over the past year.

A resurgence in retail and professional/business services jobs, however, remained a bright spot in 2018. The retail environment was also positive in McAllen, but trade and transportation industries pulled growth below 2 percent. Employment contracted half a percent in Laredo amid five consecutive months of manufacturing and retail job losses.

Manufacturing and maquiladora employment rebounded with 2,076 jobs on top of the 1,800 created in the second quarter. Reynosa and Matamoros continued to drive growth south of the border.

Employment was stable in Nuevo Laredo and Chihuahua City, adding 2,000 and 2,500 jobs YTD, respectively. In Juarez, increased violence negatively affected the labor market, leading to 7,000 lost jobs since August 2017.

Despite weaker hiring activity, unemployment rates remained historically low. Rio Grande Valley joblessness reached record lows, sinking to 6.0 and 6.3 percent in Brownsville and McAllen, respectively. Laredo’s unemployment rate balanced slightly below the state average at 3.7 percent, while the El Paso rate held at an all-time low of 4.2 percent.

Labor-market tightness failed to stimulate wage growth as inflationary pressures continued to build. Real private hourly earnings contracted YTD in all of the border metros except Brownsville.

In El Paso and McAllen, the decline was marginal at 0.3 percent, but Laredo’s wavering employment led to a 5.7 percent YTD decline in wages. On the other hand, Brownsville wages rose 7 percent YTD but remained well below their 2012 peak.

In the currency market, the peso-per-dollar exchange rate3 dropped to 18.86, falling to its lowest level since 2015 after accounting for inflation. The total value of trade passing through the Texas border metros held at more than $31 billion for the second straight month, led by increased imports through El Paso.

Brownsville’s trade activity flourished, pushing total values up 17.5 percent YTD amid steady streams of both exports and imports. Laredo posted a 0.6 percent decline in total values but remained the primary trade hub, comprising 63 percent of trade flows along the Texas border.

The new U.S.-Mexico-Canada Trade Agreement provides stability to trade-related activities, which remain an integral component to the border economies.

Housing

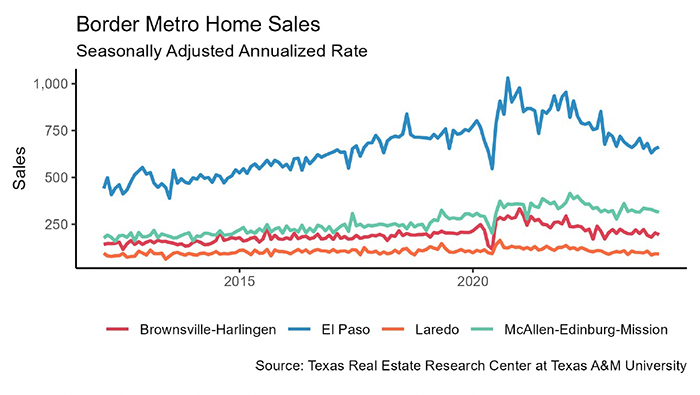

Border housing sales dipped 2 percent after reaching record levels in July but maintained an upward trend. El Paso sales through Multiple Listing Services (MLS) held at an all-time high of 732, accounting for more than half of total border activity.

Sales flattened in Laredo and contracted 6.8 percent YTD in McAllen. In Brownsville, sales dropped 7.6 percent in August but have trended upward since the start of the year as activity strengthened in the $300,000-$400,000 range.

Single-family housing construction permits increased throughout the border metros for the second straight month. McAllen led with 282 permits, accounting for 43 percent of border activity. Laredo and Brownsville balanced at 95 and 74 permits, respectively, pushing YTD growth closer to double-digits. El Paso rebounded from its slow second quarter, surpassing 210 monthly permits for the first time this year.

Border private single-family construction values, however, declined 3 percent as activity fell to more sustainable levels in the Rio Grande Valley and Laredo. These metros maintained YTD growth above 10 percent. In El Paso, single-family construction values picked up 3 percent but remained slightly below its one-year average.

The supply of active listings for homes sold through an MLS increased along the border. The Laredo total months of inventory (MOI) reached a six-year high at 5.5 months as single-family construction trended upward. New MLS listings raised Brownsville’s MOI above 8.9 months, while decreased sales pushed the McAllen MOI to eight months.

El Paso was the exception where inventories dropped to a record low of 4.2 months amid steady demand. For homes priced below $200,000, El Paso’s MOI sank below 3.5 months amid a sharp decline in new listings.

The average number of days on market (DOM) decreased in all of the border metros, signaling improved housing demand. Laredo maintained the lowest DOM at just 64 days. In McAllen, the average home sold within three months, the fastest pace of the year. El Paso’s DOM dipped below its eight-year average of 98 days, while the Brownsville DOM fell to a YTD low of 122 days.

Housing price pressures, however, eased along the border. The median sale price ticked up to $165,000 in Laredo but remained $2,000 below its all-time peak in March. Inventory expansions pulled the median price in Rio Grande Valley down to $144,400 and $138,100 in McAllen and Brownsville, respectively.

The Brownsville price, however, remained $10,000 more than its 2017 average after massive growth in the first quarter. El Paso’s median was down to $154,400 after reaching a record high in July.

![]()

Source: Texas Estate Center, a publication by Texas A&M University.