Historic growth in Texas leads to Property Tax increase

Property Tax revenue in Texas anticipated to raise 6% over a two-year period

Staff Reports

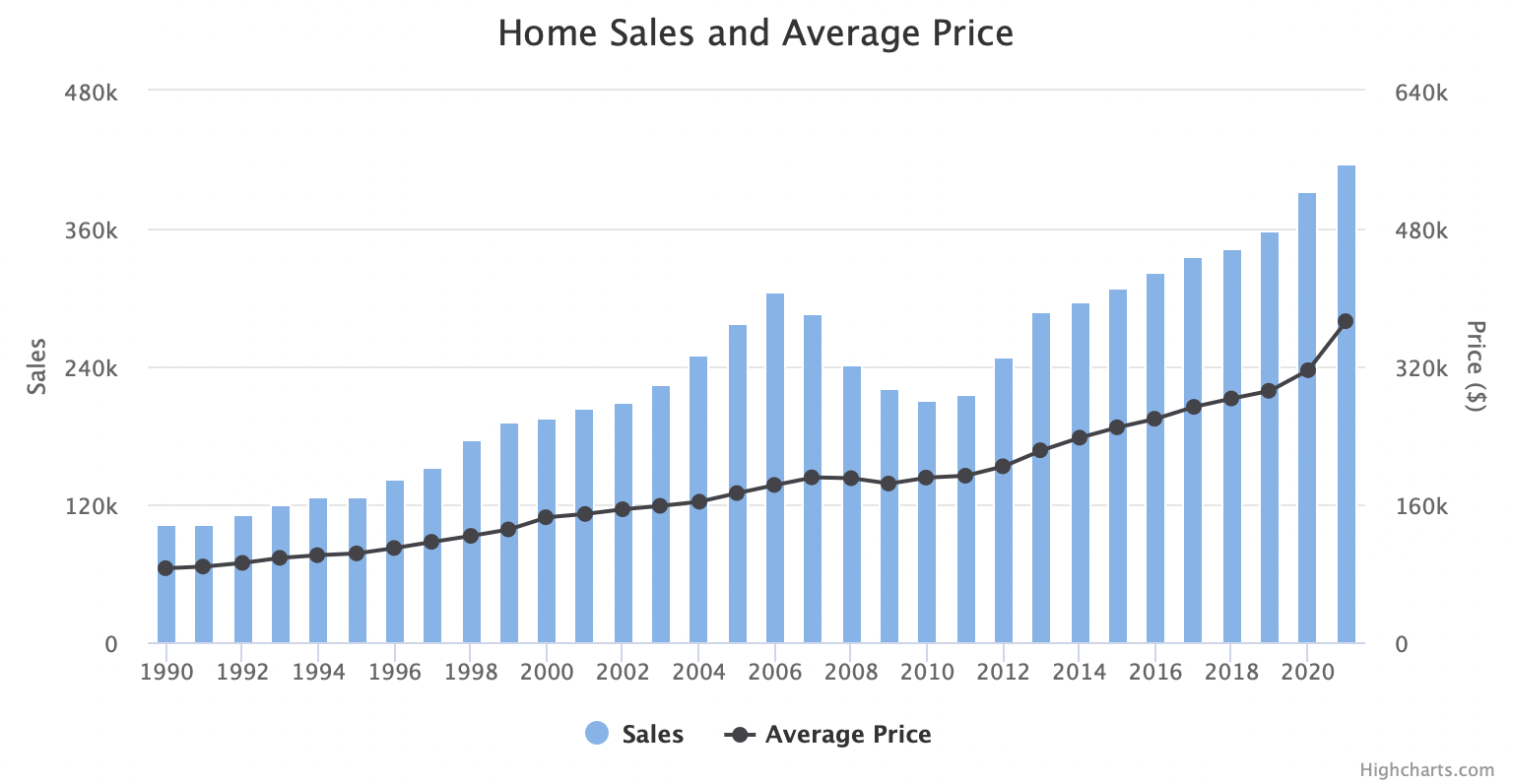

AUSTIN – The Texas Association of Appraisal Districts announced historic growth in Texas real estate values. According to the association, regions around the state have seen increases in values between 20-50% since last year.

Alvin Lankford, president of the association and chief appraiser of Williamson County said, “The Texas real estate market is growing as fast as we have ever seen it in the state’s history. We have all seen the countless stories about people moving to Texas from other states. This increase in population contributes to a shortage of homes available and to the increase in prices paid for homes.”

In a state without a personal income tax, cities, counties, hospitals, school districts and community colleges all rely heavily on property taxes. These same political subdivisions set the tax rates that determine the amount of taxes paid by homeowners and businesses.

The State of Texas also uses property taxes to the tune of over $5.6 billion in a two-year budget cycle. That’s 75% more than the state makes from the lottery. Also, in the most recent budget passed by the legislature, the state assumed that property tax revenue collected (not appraised amounts) would increase by 6% over a two-year period.

Lankford concluded with, “Considering for many of us our home is our largest investment, an increase in market value can be considered a blessing. However, many people equate an increase in market value to mean an equal increase in property taxes which is simply not the case. An increase in property taxes is sometimes needed to keep the police and fire departments adequately funded, along with our schools, hospitals, and other vital services for our communities.

However, the increase in what a person owes in property taxes is unlikely to be proportional to the increase in home values. First, there is a cap of 10% on the amount the assessed value can go up for properties with a homestead exemption. Second, caps limit how much additional revenue from property taxes a taxing unit can collect without going to the voters for approval will limit the increase in taxes. It has never been more important to have a homestead exemption and the resulting 10% cap in assessed value than it is today.”

Texas A&M Real Estate Research Center information on Texas housing market as well as major metropolitan areas:

- Amarillo MSA up 13.78% year over year

- Austin-Round Rock MSA up 35.35% YoY

- Dallas-Fort Worth-Arlington MSA up 23.55% YoY

- El Paso MSA up 14.40% YoY

- Houston-The Woodlands-Sugarland MSA up 15.19% YoY

- San Antonio-New Braunfels MSA up 18.37% YoY

- Sherman-Denison MSA up 24.53% YoY