Hays Central Appraisal District caught using unauthorized MLS data to determine home values

Sierra Martin | Managing Editor

On Tuesday, May 24, 2022, the Austin Board of Realtors (ABOR) sent a cease and desist letter to the Hays Central Appraisal District (HCAD) to stop using Multiple Listing Service (MLS) data. ABOR said they were made aware that an appraiser working for HCAD may have accessed data from their MLS system ACTRIS, violating their terms of service.

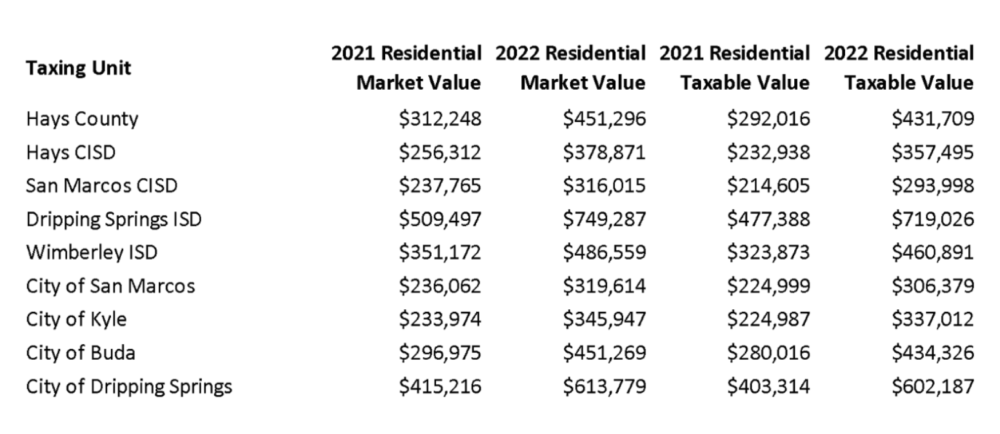

The overall market value of Hays County’s 2022 preliminary appraisal roll rose to $58.86 billion, up 53.27% from $38.41 billion in 2021, according to HCAD’s latest release of preliminary property values. If the sales prices of homes on MLS data was used by HCAD, it may result in higher assessed values for some homeowners in Hays County which could directly impact property taxes.

“We are actively investigating the source(s) of the unauthorized data access and how MLS data may have been inappropriately used in the appraisal of Hays County properties,” according to a letter sent by ABOR and ACTRIS Board of Directors President Cord Shiflet.

According to ABOR, unauthorized access to MLS data by an appraisal district or any other entity is unacceptable. In Texas, state government and local appraisal districts do not force buyers or sellers to report a property’s sale price.

“The Texas legislature has been clear about the respect, freedom, and privacy homeowners should have regarding their home purchases and sales, and we will not interrupt that expectation,” the letter stated.

ABOR also said that HCAD violated the rules regarding the authorized use of the MLS platform since they are not a government entity. Additionally, licensed appraisers with authorized access to the MLS are prohibited from sharing MLS data beyond providing appraisals for consumers.

The HCAD website says that home appraisals are made once every three years, and “each parcel of property in Hays County is visited and reviewed by an appraiser (or data collector) from the appraisal district in accordance with Texas Law.”

The HCAD website also says that they generally use three approaches when appraising a home: the cost approach, income approach and a sales approach. HCAD said they maintain a database of real estate transactions in order to complete the sales approach. Corridor News reached out to HCAD and did not receive a response for comment on the cease and desist letter.

CEO of Central Texas MLS, Beckie Whittier, said that appraisal districts are not supposed to have access to MLS data.

“The reason they don’t have access to our [MLS] data is [because] it’s not their data,” said Whittier. “The data is for the brokers and the participants and subscribers that pay for the service that are realtors and appraisers that are also realtors.”

According to ABOR, the unauthorized use of MLS data by county appraisal districts is an ongoing issue across the state of Texas. According to KVUE, in 2019, the Travis Central Appraisal District was similarly sent a cease and desist letter for the unauthorized use of ACTRIS MLS data.

ABOR also told their members that they are taking actions to “ensure full accountability from all parties enabling the unauthorized exploitation of ACTRIS MLS data.”

Emily Chenevert, Chief Executive Officer of ABOR, said they are taking the issue seriously and working to find a resolution for homebuyers and sellers in Hays County.

“The Austin Board of Realtors and ACTRIS MLS take issues of misuse of the MLS service seriously. The Texas legislature has been clear about the respect, freedom, and privacy homeowners should have regarding their home purchases and sales, and ABoR is not going to interrupt that expectation,” said Chenevert.

According to the ABOR ACTRIS MLS Rules and Regulations, within ten business days of receiving the cease and desist letter, the HCAD must either remove the unauthorized content or provide proof that the use is authorized. Any proof submitted will be considered by the MLS Compliance Committee or assigned staff, and they will decide if the use of the MLS data is authorized within thirty days.

“While we cannot offer further information at this time or speculation on potential outcomes or timelines, homebuyers and sellers should rest assured that we are working to find a resolution to this issue as quickly as possible.”

This is a developing story. San Marcos Corridor News will provide updates as they are made available.

Only in Texas. Why would lawmakers want to make it HARDER for counties to accurately and fairly assess property values? Without real world data, how are CADs supposed to do their difficult job? This situation is akin to letting car dealers hide the terms of their sales, thus forcing the state to guesstimate the tax due. Stoopid, like so much that passes for the defense of Liberty but is in fact, defense of rich folks’ bottom lines. … And don’t get me started on abuse of the ag exemption in Hays County, which gives rich folks a property tax break for some few pet cattle they keep around for that purpose.

First, this wasn’t lawmakers standing in the way of anything. It sounds like this is the MLS teams rightly questioning the use of their data. People pay good money to have access. Why should the CAD get it for free?

Secondly, do you really want to suffer the whipsaw of bubble & bust cycles? Homes in La Cima have lost $150K in value THIS MONTH! How would a government be able to accurately plan for the future? What about the homeowner? No, this needs to be smoothed. The county clerk and CAD will eventually be notified of the sale. They can do their own work from their.

Who are the “rich folks?”

The exact same homes that someone paid $200,000 a few years ago are now being appraised at $500,000 based on other people’s purchased property. So our affordable house that we bought based on our income is now being appraised and taxed based off the artificial housing shortage caused by the government forced foreclosure and eviction bans. Whenever there’s a decrease in supply it increases demand and increases prices. Now, Hays county is directly benefiting financially from the housing shortage they caused. High rental rates are directly tied to taxes because landlords pass the cost of taxes in the rent.

Now that we are facing a recession those same new homeowners are going to be underwater on their loans.

Buda in 2019, Hispanics had the lowest poverty rate of any group. Buda in 2022, Whites now have the lowest poverty rate.

You are a prime example of why financial literacy should be mandatory to graduate high school.

Robert, per the article, “[t]he Texas legislature has been clear about the respect, freedom, and privacy homeowners should have regarding their home purchases and sales,” I take this to mean the Lege could codify CAD access but won’t. The reasons given are bogus (see below).

“Secondly, do you really want to suffer the whipsaw of bubble & bust cycles?”

Robert, maybe you can enlighten me: do you expect your property tax to go up in step with your appraisal? Doesn’t the county set the tax rate after the appraisals are settled? Don’t the commissioners set the rate to whatever is required to generate the same amount of revenue as the previous year, plus a scootch for budget creep? …. The inflationary whipsaw you refer to is a HUGE anomaly. It’ll be over before ya know it.

The MLS is the best source for accurate market data. The CADs should get that info for free. They are not competing with Realtors; Realtors lose nothing by cooperating. Fairness requires accuracy. Property tax payers deserve this, obviously. Why should homebuyers have transactional privacy? In what other commercial area are buyers and sellers shielded from gov’t scrutiny? I can’t think of one. (Used-car transactions were reported on the “honor system” once upon a time, but no more.)

1. That isn’t making it hard-ER! That sounds like a continuation of current policy. A policy that has probably been in effect for decades. We have managed. I don’t see a need to change.

2. Government imposing its own access on private property without just compensation is a violation of the 5th Amendment of the U.S. Constitution.

3. If the CAD sets rates then they don’t need access to the MLS because all they need to know is how much money they need and the current appraised value. There are an infinite number of ways to impose a $500 monthly tax. $500 = mx+b, that’s middle school math.

4. Why should homebuyers have transactional privacy? Why shouldn’t you be forced to tattoo your medical status on your face for all to see? Really… what business is it for anyone to know exactly what I paid for my house, and where does it stop? Unfortunately, the fact is that home sales/pricing data is already publicly available. It is listed on the CAD website. It is a bit delayed, but they already have it!

The CAD to be taking MLS data is outside their scope and that ultimately encourages lazy assessors. ==> Remember pre-2008? Whipsaw.

The CAD doesn’t set tax rates. The county commissioners do that. They can set the rate higher or lower. They will determine that rate in August, after county departments have submitted their expected funding needs for next year.

A public hearing on the proposed tax rate will be held Aug. 23. … Be there or stop complaining.

The CAD sets the underlying property value.

County commissioners merely tax the value set by the CAD.

Get your reality straight, Richie

Whichever… The result is the same. Government budgeting requires predictability. Markets can be wild. Housing prices boomed. Now housing prices are crashing. That’s not predictable.

Government using market data is plain dumb. They have everything they need. Just stop being lazy.

We purchased our 21 yr old house in 2021. Prior to purchase the value was $289k. Great, we were thinking older home, lower tax. Then we got our tax bill. $425k . What?? We protested and we were told in the protest exactly how much we paid and HOW we paid for our house. That information should be no one’s business but ours. The only upgrade we did is a fresh coat of paint. How did they find out this info? Because one of the people on the review board is a licensed realtor. She got it off MLS. It should be illegal. We don’t mind paying tax on the property but let’s be fair. We are in Johnson county. Our previous home was in Tarrant county. The people that bought our house are paying 8% more than we did.

The unauthorized access and use of MLS data by appraisal districts, as highlighted in the article, is a serious concern that compromises homeowners’ privacy and rights. ABOR’s stance on upholding homeowner privacy is commendable, emphasizing the need for accountability and adherence to regulations. It’s essential to ensure that such unauthorized access is curbed to protect homeowners’ confidential information and maintain the integrity of the appraisal process.