Debt At A Glance: A Financial Look At Hays County

![]() In addition, the debt is shown for the county only, and not for other political subdivisions that may have outstanding debt, taxing powers, and the same boundaries as the county…

In addition, the debt is shown for the county only, and not for other political subdivisions that may have outstanding debt, taxing powers, and the same boundaries as the county…

![]()

It’s budget time again for Texas counties, cities and some school districts, and Corridor News wanted to share the most recent financial and debt information available for Hays County and local government and education agencies.

Over the next week, Corridor will be sharing a series of articles of Debt at a Glance for Hays County, San Marcos, Kyle, Buda, Wimberley, Dripping Springs, Woodcreek, Mountain City, Hays and Niederwald including Hays CISD, San Marcos CISD, Wimberley ISD and Dripping Springs ISD.

There are multiple public hearings scheduled and coming up quickly. These meetings will allow residents to have a say on how much their city, county and school districts are spending, what they are spending on and how much they are in debt.

The information and graphics below come directly from the Texas Comptroller’s office.

![]()

• DEBT AT A GLANCE — HAYS COUNTY, TEXAS •

The data on this page is provided as of the date indicated and may not reflect debt, population or other data as of any subsequent date.

In addition, the debt is shown for the county only, and not for other political subdivisions that may have outstanding debt, taxing powers, and the same boundaries as the county.

Debt of a controlled non-profit corporation is included as the debt of its sponsoring county, even if non-recourse.

For more information on the types of debt, refer to our Debt Glossary.

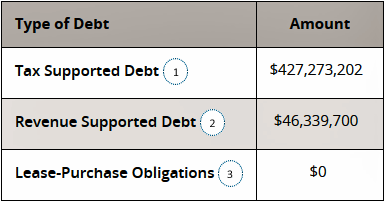

Current Debt Obligations for Hays County

Debt Outstanding Hays County, Texas as of August 31, 2016

(1) Tax-supported debt is backed by a pledge of property taxes levied within the issuer’s boundaries. Some tax-supported debt may be secured by a combination of property taxes and other revenue sources. It generally must be voter-approved (with exceptions for COs, tax notes, school district maintenance tax notes, and certain county road bonds and contractual obligations for personal property.)

(2) Revenue-supported debt is secured by non-property tax revenue such as sales tax, tuition, admissions to athletic events, tolls, or water, gas, or electric municipal utility charges. As used in this site, it does not include debt that is also payable from property taxes. Revenue-supported debt generally does not require voter approval.

(3) Lease Purchase is financing the purchase of an asset over time through lease payments that include principal and interest. Lease purchases can be financed through a private vendor.

CABs Outstanding for Hays County, as of August 31, 2016

A Capital Appreciation Bond (CAB) is a debt instrument governments can use to fund buildings, parks, roads and other capital projects. For conventional bonds, principal and interest payments are made in installments, generally once a year for principal and twice a year for interest.

CABs, by contrast, require no payments of any kind until the date on which the debt becomes due, or the maturity date. At that time, the full amount of the principal plus all of the compounded interest accrued, frequently referred to as the maturity amount, must be repaid to the investor as a single lump sum.

• No CABs data available for Hays County

![]()

![]()

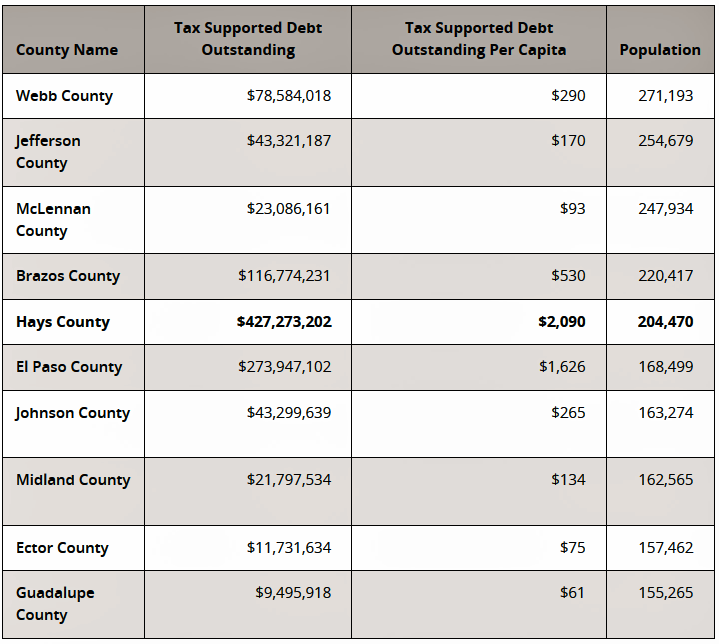

How Hays County Compares

Tax-Supported Debt Outstanding for Counties of Similar Size, as of August 31, 2016

Note: The table includes Hays County and nine counties with closest population numbers based on 2016 U.S. Census Bureau population data. Tax-supported debt does not include revenue debt and lease-purchase obligations.

Some counties provide health care, transportation, drainage or other services directly, while others do so through separate hospital districts or authorities, toll road authorities, drainage districts or other political subdivisions.

The comparison does not reflect debt of separate political subdivisions, even when they have the same boundaries as the counties.

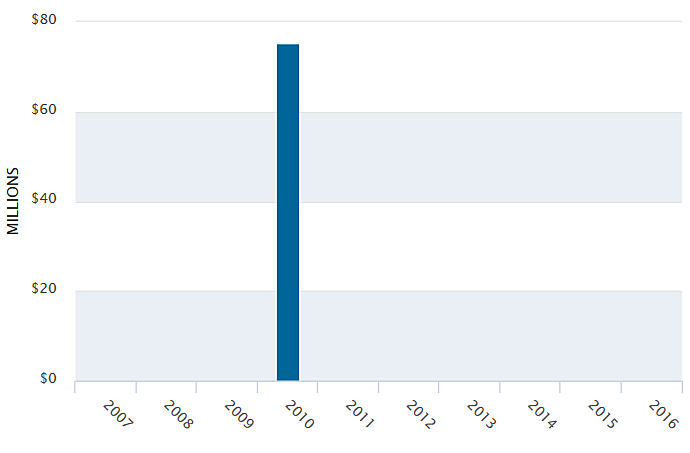

Certificates Of Obligation Issuances

Certificates of Obligation (COs) allow certain cities, counties and hospital or health districts to issue debt without voter approval (unless a referendum is petitioned) and are backed by tax revenue, fee revenues or a combination of the two.

Note: Amounts are estimates and have not been adjusted for inflation or population growth. The Bond Review Board has reconciled Certificates of Obligation issuances from 2003 through 2016.

![]() z

z

![]()

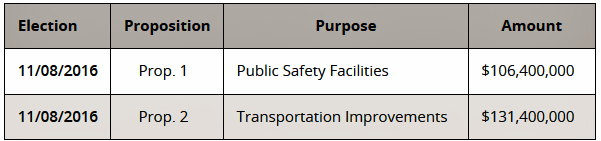

• Defeated Bonds

No data available.

Source: Hays County

Note: Does not reflect authorized but unissued debt, if any, approved at earlier elections.

Proposed Bond Issuances

• No data available.

• Note: Reflects only referenda currently known and verified by the Comptroller’s office at this time.

• For a full list statewide, see the Upcoming Bond Election Roundup.

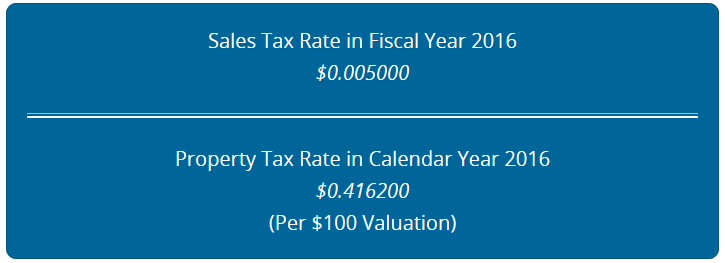

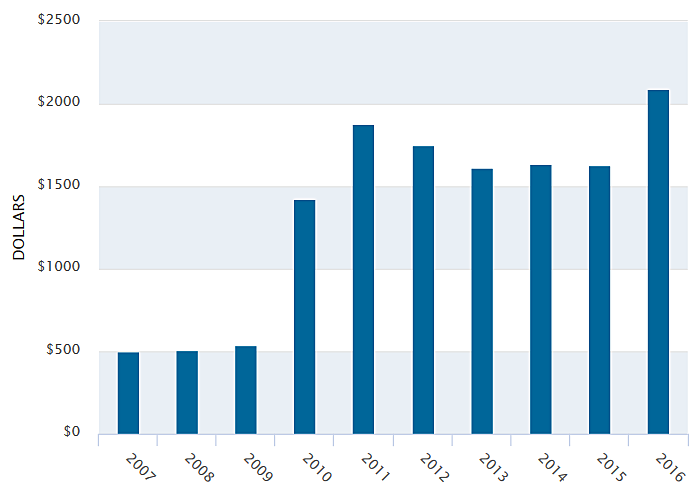

Debt Trends

Hays County Tax-Supported Debt Per Capita

Outstanding at Fiscal Year End: 10-Year Trend

Per Capita: per unit of population — by or for each person

Use example: “the highest income per capita of any state in the union”

• Note: Reflects debt in 2016 dollars divided by estimated population in the relevant year. Some debt issued before 2003 may not be reflected.

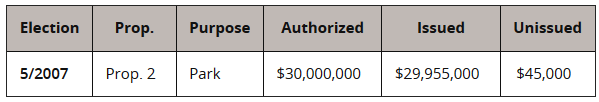

Authorized But Unissued Tax-Supported Debt

After voters approve tax-supported debt for a local entity in an election, the entity applies to the Attorney General (OAG) to approve issuance before debt is issued. Typically, the entity does not apply for the OAG to approve the total debt package at once, but rather over time so that it can manage the projects and reduce interest expense. Authorized but unissued tax-supported debt totals are the remaining voter-approved tax-supported debt that the entity has not issued yet and may be issued in the future.

• Note: Reflects authorized but unissued tax-supported debt as of August 31, 2016. Some debt authorized before 2003 but still unissued may not be reflected.

An Introduction to Understanding

Comprehensive Annual Financial Reports

When you’re ready to learn about a public entity’s fiscal health, you’ll find a great deal of information in comprehensive annual financial reports (CAFRs) and other yearly reports. Often posted online alongside other financial information, CAFRs report an entity’s accounting statements, debts and other key information for the past year.

But sometimes that information can be tricky to find – and tough to understand. Because of that, our office compiled some tips for locating an entity’s CAFRs and for understanding them. You’ll learn how all CAFRs have certain similarities and when and why different entities’ CAFRs will differ in key ways. Plus, we detail strategies for pinpointing the debt, expenditure and revenue information you need to hold a government entity accountable.

Note that the data in the following publications is presented as of the dates indicated in the publications and may not reflect debt, population or other data as of any subsequent date. For further or more current information, see the applicable entity’s web site or its most recent filings at Electronic Municipal Market Access (EMMA®). The Comptroller does not control or guarantee the accuracy, completeness, or currency of any such site. When you access any such site, you will be leaving the Comptroller’s website.

Read the Texas Comptroller’s Guide to Understanding Comprehensive Annual Reports (CAFRs)

To learn more about the finances of public pension plans that may

operate in this jurisdiction, please visit our public pension search tool.