Review Of April’s Texas Border Economy

Wage improvements combined with declining mortgage rates boosted housing sales along the border. Permit issuance normalized after slowing through much of 2018 while multifamily construction values continued to trend upward.

As the peso appreciated, U.S. industrial production retreated.

Wait times at the border increased, causing trade values to remain suppressed. Challenges to the border communities moving forward include political uncertainty regarding immigration reform and trade, which remains an integral component of the local economies.

Economy

Economic activity accelerated along the border as indicated by the Dallas Fed’s Business-Cycle Indices.

Supported by labor market improvements, the McAllen and Laredo indices surged to 14.4 and 5.7 percent growth, respectively, on a seasonally adjusted annualized rate (SAAR). The El Paso index inched up 2.2 percent while Brownsville’s metric rose 2.6 percent amid moderate hiring.

Total border construction values faltered as nonresidential activity took a step back. A slowdown in El Paso school construction after a busy first quarter, however, explained much of the slump.

On the other hand, residential activity picked up after a five-month decline. The multifamily sector recovered after a brief pause last month, but single-family investment remained tepid.

Nonfarm employment expanded for the fifth consecutive month, hovering at 2.5 percent SAAR. On top of reaching a cycle-high quarterly increase last month, McAllen accelerated to 4.3 percent, adding 500 jobs. Retail trade employment corrected after slowing in March while the manufacturing job growth remained strong.

El Paso added 400 jobs as the construction industry surged, and growth in the trade sector steadied. In Laredo, education/health services continued to shed jobs, but gains in professional and business services supported 2.7 percent growth. Brownsville was the exception as education/health employment fell to its lowest level since July 2018, resulting in a 400-job contraction.

On the Mexican side of the border, manufacturing and maquiladora employment1 stabilized, adding 11,800 jobs in the first quarter. Chihuahua led in terms of YTD growth at 8.9 percent, gaining 6,200 jobs.

Maquiladora employment in Matamoros continued to rebound after a strike in January, adding 3,500 workers in March. Despite two months of sluggish hiring, Nuevo Laredo maintained 2.9 percent YTD growth.

After six straight months of employment expansion, Juarez shed 3,000 jobs amid high turnover rates and reduced industrial manufacturing. Despite the reduction, the city registered 1.4 percent YTD growth. Similarly, Reynosa contracted 0.3 percent in March after reaching record high employment to start the year, but growth remained positive in the first quarter.

Unemployment rates dipped along the border to historical lows. Joblessness in McAllen and Brownsville decreased for the second straight month to 6.2 and 5.7 percent, respectively.

Steady hiring in El Paso brought unemployment down to 4 percent. The exception was Laredo, however, where joblessness hovered just above the record low of 3.7 percent.

For the first time in eight years, all four border metros recorded an improvement in real private hourly earnings. The nominal wage gap between El Paso, the highest paying border metro, and the statewide average continued to decrease as the West Texas metro’s inflation-adjusted earnings increased 2.2 percent YOY.

Although nominal wages in the Rio Grande Valley declined, real earnings extended an upward trend, posting 4.8 and 4.3 percent YOY growth in Brownsville and McAllen, respectively. Laredo broke a 28-month streak of falling wages with 1.2 percent YOY growth but has a long recovery ahead.

In the currency market, the peso per dollar exchange rate fell to 18.96 in concordance with a decrease in the inflation-adjusted rate2, making domestic goods less expensive to Mexican buyers.

Total trade values passing through the border metros dipped on top of suppressed first quarter activity. Import values fell due to increased wait times at the border and tariff uncertainty disrupting supply chains. In addition, U.S. industrial production decreased, causing import demand to decline.

Housing

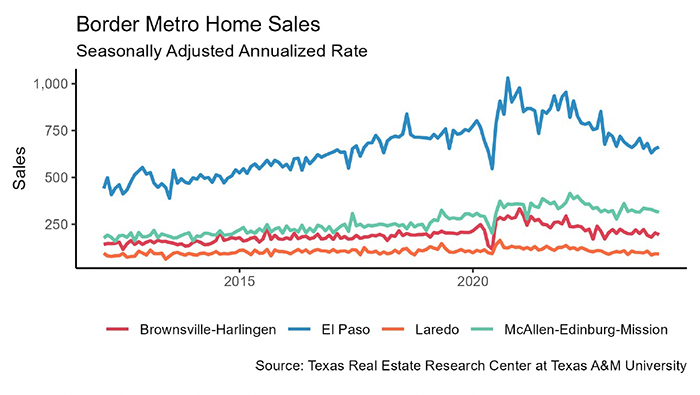

Amidst increased purchasing power and steady hiring, the border registered a 5.1 percent increase in housing sales. Activity in Laredo boomed 20.1 percent as sales for homes priced above $200,000 extended an upward trajectory.

Sales in the Rio Grande Valley were bolstered 6.7 and 3.9 percent in McAllen and Brownsville, respectively, by a wave of transactions for homes priced below $100,000.

Activity in this price cohort moving forward may slow, however, as inventory dwindles in an environment of rising costs. El Paso registered 3.0 percent growth as sales in the $200,000-$300,000 price cohort remained strong.

On the supply side, the border metros issued a total of 540 single-family housing construction permits, increasing 2.1 percent. Much of the growth was attributable to activity in McAllen correcting two straight quarters of decline amid rising inventory levels.

Brownsville permits steadied to regular post-recessionary levels while El Paso activity continued to normalize following a depressed 2018. Permit count in Laredo stabilized after a cycle-high in February.

Private single-family construction values trended downward in Laredo and McAllen and tapered off in El Paso. Construction values in Brownsville extended an upward trend following a six-month slide last year.

The months of inventory (MOI) of homes for sale fell along the border to record lows. El Paso inventories remained below the statewide average for the fourth consecutive month at 3.5 months.

Laredo ticked down to four months while Brownsville registered 7.6 months. The McAllen MOI dipped below 8.2 months, but hovered above January 2018’s historical low of 7.5 months.

Corroborating healthy demand, the average number of days on market (DOM) trended down across the border metros. Homes in McAllen sold more than two weeks faster than a year ago, averaging 84 days on the market.

El Paso registered a post-recessionary low DOM at 74 days, more than three weeks less than last April. The Laredo metric stabilized at 62 days after jumping up to the highest level in over a year in March. The exception was Brownsville, where the DOM stabilized at 120 days, hovering just below its four-year average.

After reaching historical highs in the first quarter, median home prices cooled along the border. The median prices in Laredo ($185,600) and McAllen ($149,000) fell $7,300 and $9,500, respectively, after peaking in March.

The Brownsville metric slid $3,000 below its year-long average to register $140,400. Growing demand for homes priced above $300,000 in El Paso pushed the median price above $162,300, however, a steady stream of listings in the same price cohort kept the median price from nearing its record high of $166,600.

_______________

1 Mexican manufacturing and maquiladora employment is generated by the Instituto Nacional de Estadística y Geografía. Its release typically lags the Texas Border Economy by one month.

2 The real peso per dollar exchange rate is inflation adjusted using the Texas Trade-Weighted Value of the Dollar.

Source: Texas Estate Center, a publication by Texas A&M University.