San Marcos CISD Board To Discuss Budget, Proposed Tax Rate

Staff Reports

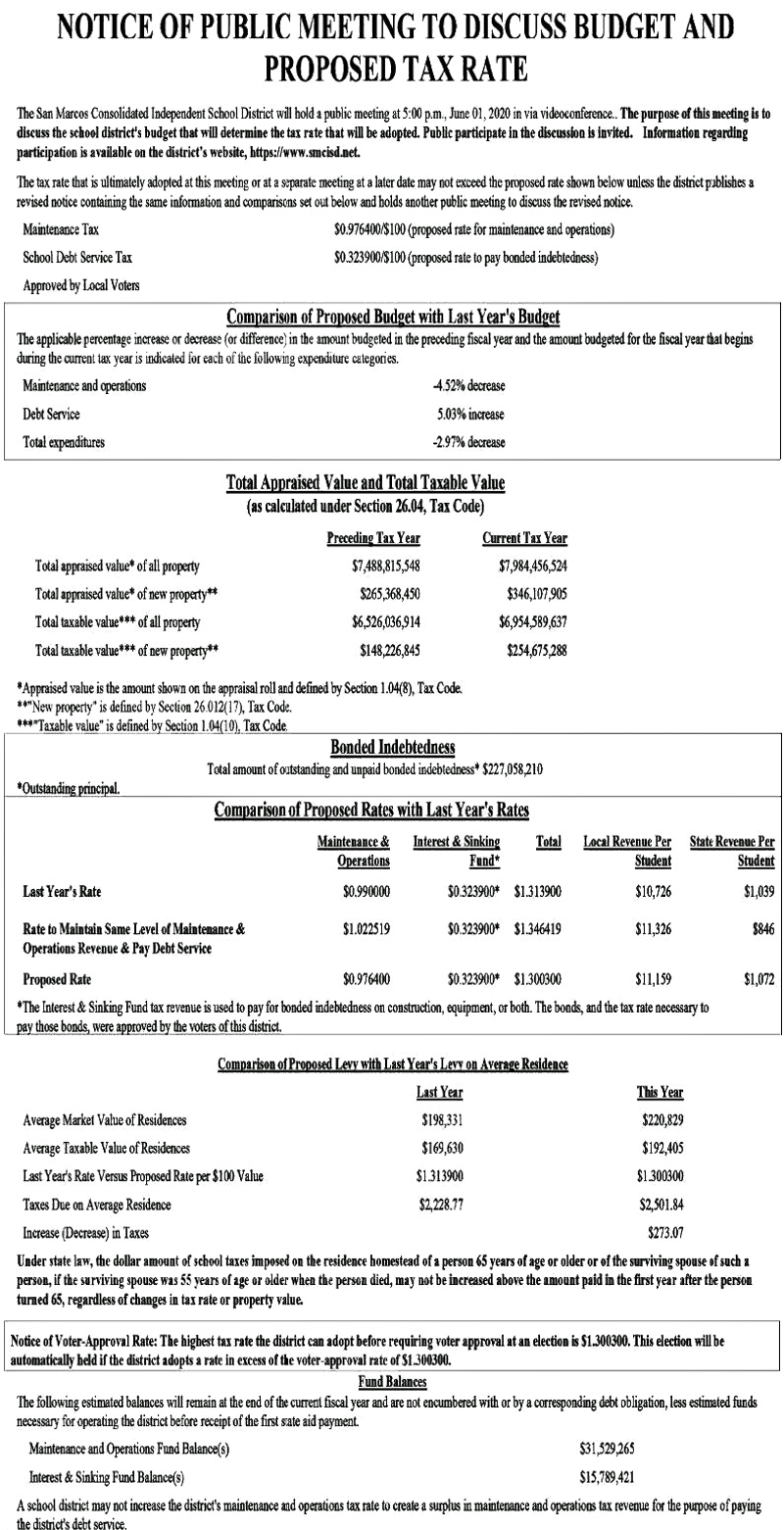

The San Marcos Consolidated Independent School District will hold a meeting at 5:00 PM on June 1 to discuss the school district’s budget and determine the tax rate that should be adopted.

Last Year’s Budget Comparison:

- Maintenance and Operations = -4.52%

- Debt Service = 5.03%

- Total Expenditures: -2.97%

Total Appraised Value and Total Taxable Value:

Comparison of Proposed Rates & Last Year’s Rates

- Last Year’s Rate = $1.313900

- Rate To Maintain Same Level of Maintenance & Operations Revenue = $1.346419

- Proposed Rate = $1.300300

Homeowners are projected to pay $2,501.84 in property taxes on the average home value this year if the district adopts the proposed tax rate of $1.30 per $100 value.

Last year, the average homeowner paid $2,228.77 at the tax rate of $1.3129 per $100 value.

According to the district, they will end Fiscal Year 2020 with a fund balance of $31,529,265 in the maintenance and operations fund and $15,789,421 in the interest and sinking funds.

The meeting will be held via videoconferencing, but public participation in the meeting is invited, according to the district.