San Marcos Releases Notice Of Proposed 2020 Tax Rate, Increase In Water & Wastewater Rates

Staff Reports

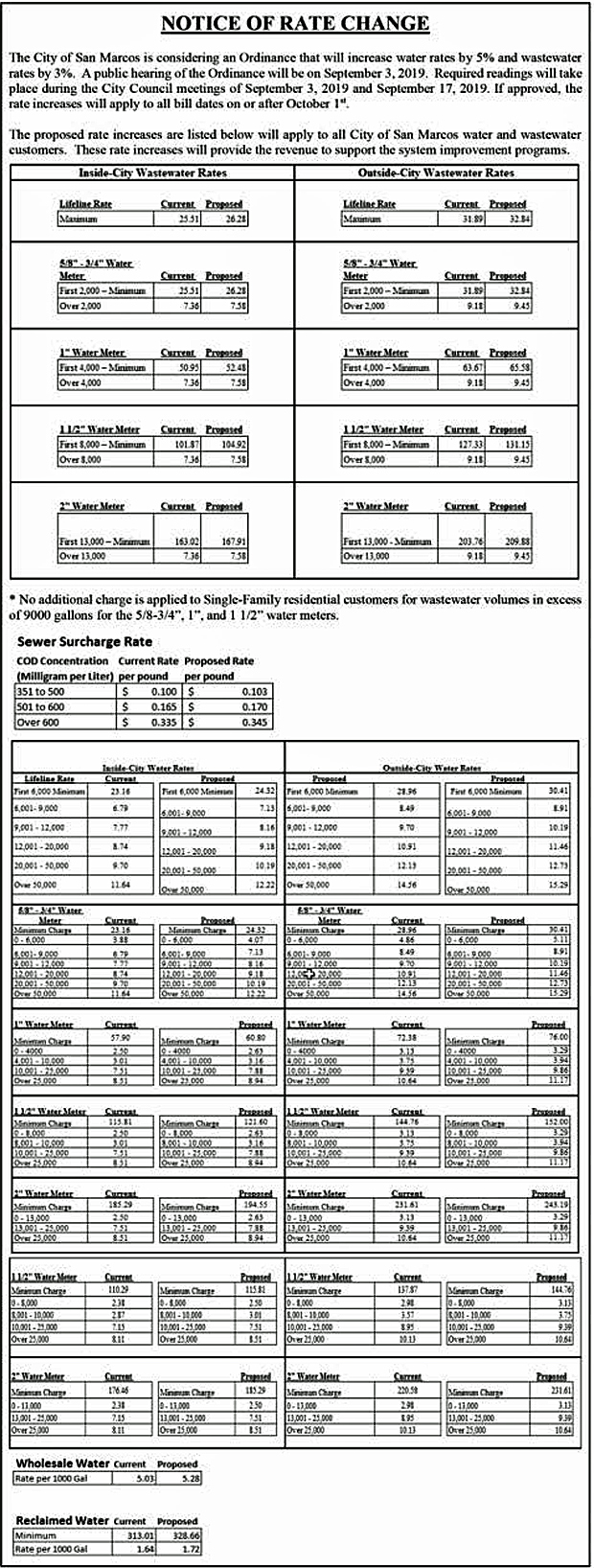

On Sunday, the San Marcos City Council released their public notice regarding the 2020 Tax Year Proposed Tax Rate.

The City of San Marcos is proposing a tax rate of $0.6139 per $100 valuation, which is the same as the 2019 Tax Year’s tax rate.

According to the notice, the tax rate would exceed the effective tax rate of $0.5686 per $100 and be just under the rollback tax rate of $0.6139 per $100.

“This year’s effective tax rate would impose the same total taxes as last year if you compare properties taxed in both years. This year’s rollback tax rate is the highest tax rate the taxing unit can set before taxpayers can start tax rollback procedures.

San Marcos’s FY 2020 Proposed Budget has not yet been released to the public as of yet. The yearly proposed budgets would include the individual expenditure, revenue totals and a complete budget total. Corridor News requested a copy of the 2020 proposed budget on August 7, and as of the time of press time, there had been no response from the San Marcos Department of Finance.

PUBLIC HEARING ON TAX RATE & FY20 BUDGET

PUBLIC HEARING ON TAX RATE & FY20 BUDGET

• August 20: Tax Rate – First Reading

• September 3: Tax Rate – Second Reading

• September 3: Budget Reading – First Reading

• September 17: Budget Reading – Second Reading

• September 17: Budget Adoption Vote

BUDGET WORKSHOP PRESENTATIONS

• FY20 Budget WorkShop June 26-27th FINAL

• FY20 Budget WorkShop Aug 1, 2019 FINAL

The City of San Marcos approved a $229,369,259 FY 2018-2019 budget last year. Between rising property values and the new property that is added to the property tax rolls, the city of San Marcos saw an additional $2.9 million more in property tax revenue than in 2017.

The community enhancement fee generated $1.1 million in revenue in 2016 and 2017; revenue for 2018 was projected to be the same.

San Marcos Property Tax Rates &

Budget Totals for Last Five Years

• 2019: .6139 | $229,293,482

• 2018: .6139 | $214,149,795

• 2017: .5302 | $193,811,647

• 2016: .5302 | $187,054,821

• 2015: .5302 | $173,012,214

Effective & Roll Back Rate Totals for Last Five Years

• 2019: .5899 | .6596

• 2018: .5252 | .6228

• 2017: .5143 | .5743

• 2016: .5099 | .5491

• 2015: .5089 | .5427

![]()

HAYS COUNTY 2020 PROPOSED BUDGET

Hays County Commissioners received the Judge’s recommended budget on July 30, which was made available online to residents on August 2.

County Commissioners are slated to hold the third and final public hearing on the budget on August 20. The Hays County Judge Ruben Becerra proposes a tax rate of $.4337 per $100 valuation and a budget total of $948,384,860. The effective tax rate would be $0.4051.

![]()

CITY OF KYLE 2020 PROPOSED BUDGET

The City of Kyle released their proposed budget on July 27 and scheduled its first public hearing for August 14 at 7:00 PM.

The Kyle proposed budget cites an anticipated $87.1 million total in city expenditures for FY 2019-2020 and the ad valorem tax rate of $0.5416 per $100 assessed taxable valuation.

![]()

CITY OF BUDA 2020 PROPOSED BUDGET

The Buda City Council received their proposed FY 2020 budget presentation at their August 6 meeting and has set public hearings for August 20 and September 6 at 6:00 PM.

The City of Buda proposes a property tax rate of $0.3496 per $100 valuation, which is a decrease from the current property tax rate of $0.3710 per $100 valuation.

The projected total revenue is $35,982,099 excluding capital improvements and $38,326,383 in expenditures.

![]()

CITY OF AUSTIN 2020 PROPOSED BUDGET

The City of Austin has proposed a budget with a rollback tax rate of $0.4386 per $100 of taxable value, which is a slight decrease from the current tax rate of $0.4403.

This budget will raise more total property taxes than last year’s budget by $60,587,697 or 9.0%, and of that amount, $14,689,327 is tax revenue to be raised from new property added to the tax roll this year.

The City Manager was slated to present the FY 2020 budget to the Austin City Council on August 6.

![]()

SAN MARCOS VS. AUSTIN PROPERTY TAX RATES

For the second year in a row, the City of Austin is proposing the adoption of a tax rate that is lower than the City of San Marcos’s.

In 2017, Austin adopted a tax rate of $0.4448 per $100 for FY 2018, $0.1691 lower than San Marcos’s $0.6139 per $100 valuation.

According to FY 2019 budget, Austin officials approved a property tax rate of $0.4403 per $100 valuation, which was $0.1736.

![]()

WHERE DOES YOUR LOCAL SALES

TAX DOLLARS GO IN SAN MARCOS?

Sales taxes represent 44.4 percent of the total General Fund revenues and the greatest single source of revenue for the General Fund. Any excess collection above the fiscal year 2019 estimate goes directly into General Fund balance, or the budget can be amended to allocate these amounts.

The City of San Marcos collects one and one-half cents on every dollar spent on taxable goods and services within the city limits.

The State of Texas allows home-rule cities like San Marcos to adopt a one-cent sales tax to support general governmental services.

Local voters authorized another half-cent in 1987 dedicated solely to the reduction of property taxes. The one- and one-half cents collected by the City represents the maximum they may adopt.

The half-cent sales tax alone is expected to generate $11,906,000 in the next fiscal year, a sum that is equivalent to $0.2352 on the property tax rate.

Without the half-cent sales tax dedicated to property tax reduction, the city’s ad valorem tax rate would have to be $0.2352 more, or $.8491 per $100 of assessed value, to support the programs and services provided to San Marcos residents.

![]()

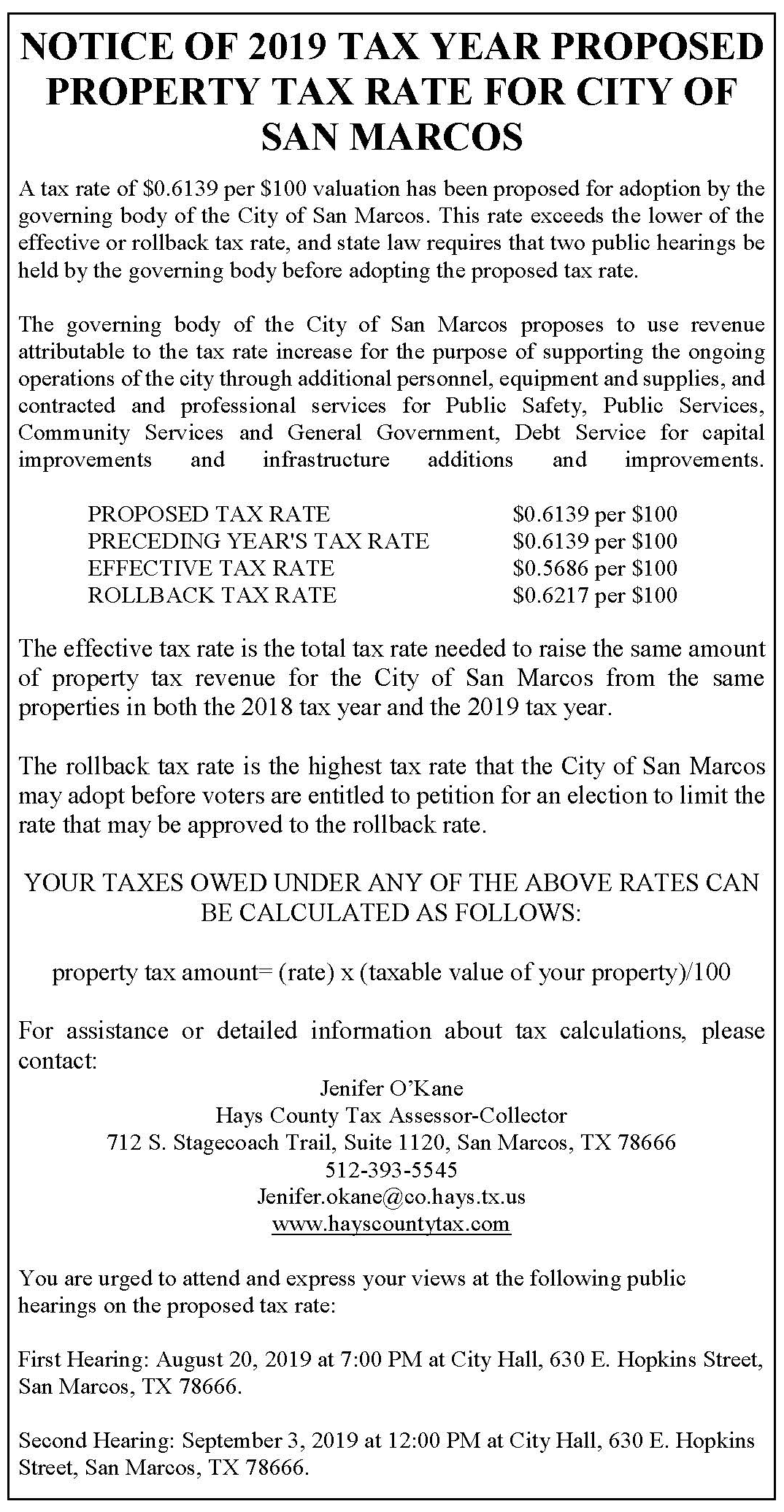

FOR FY 2020, THE CITY OF SAN MARCOS IS REQUESTING

A RATE INCREASE FOR WATER AND WASTEWATER

The City of San Marcos released a public notice regarding a rate change to water and wastewater rates. The ordinance to change water rates by five percent and wastewater by three percent will go before the dais for the first reading on September 3. The second reading will take place on September 17; if approved, the new rate will take effect on October 1st.