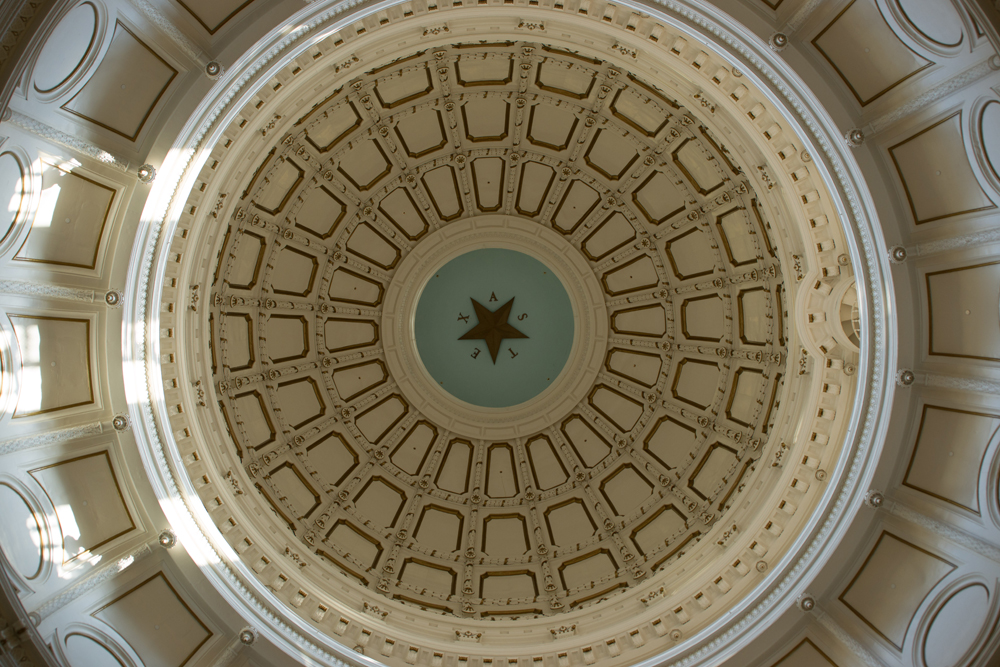

Texas Legislature Week In Review: TAC Gives A Rundown Of What Happened Last Week At The Capitol

By, Texas Association of Counties

We are less than 25 days away from sine die, the last day of the regular legislative session. The House passed SB 2, the 3.5 percent revenue cap bill, and the measure now moves to a conference committee.

The chamber also approved legislation that would repeal the onerous Driver Responsibility Program and replace funding for trauma centers with other revenue.

Legislation that would reduce marijuana penalties and provide judicial and prosecutor pay raises passed the House, while the Senate approved a bill that would reform certain ballot propositions.

A priority bill for the sheriffs passed both chambers and a House committee looked at a way to boost disaster assistance funding.

SB 2 Heads to a Conference Committee

After a lengthy floor debate, the House passed SB 2 by Sen. Paul Bettencourt (R-Houston), the priority property tax legislation that imposes a 3.5 percent revenue cap. The bill now heads to a conference committee to reconcile the differences between the House and Senate versions. Additional information about the legislation is available in this Property Tax Bill article.

House Approves DRP Repeal 143-0

On May 2, the House approved HB 2048 by Rep. John Zerwas (R-Richmond), a bill that repeals the Driver Responsibility Program (DRP) while preserving funding for trauma centers. The legislation eliminates program surcharges assessed on drivers convicted of certain offenses and replaces lost revenue with increases in certain fees and fines.

The House adopted six floor amendments for technical corrections including clarity on indigency. The bill now moves over to the Senate for consideration. Please consider reaching out to your senator and expressing your support.

Ballot Propositions and Bond Elections

The Senate passed SB 2219 by Sen. Paul Bettencourt (R-Houston), a bill that outlines specific requirements for ballot propositions seeking voter approval of the issuance of bonds or the imposition or increase of a tax. It also requires a proposition for the approval of the issuance of bonds or other debt be submitted to voters on the November uniform election date, with certain exceptions.

When the bill was considered by the Senate Property Tax Committee, a number of representatives of commissioners courts, cities and various associations registered against the bill. The bill now heads to the House.

Reducing Marijuana Penalties

On April 30, the House passed HB 63 by Rep. Joe Moody (D-El Paso), a bill that would make the possession of one ounce or less of marijuana a Class C misdemeanor. It also prohibits a peace officer who is charging a person with the offense of possessing one ounce or less of marijuana, or possessing certain drug paraphernalia, from arresting the person. Instead, the officer is required to issue a citation.

The bill passed the House by a vote of 103-42, with two present, not voting. However, the legislation may not fare well in the Senate. Lt. Gov. Dan Patrick recently stated that the legislation is dead in that chamber. The measure has been received in the Senate, but has not yet been referred to a committee.

Judicial and Prosecutor Pay Raises

On May 1, the House passed HB 2384 by Rep. Jeff Leach (R-Plano), a bill that would authorize pay raises for certain judges and prosecutors. Under the provisions of the legislation, district judges, statutory county court judges, statutory probate judges and appellate judges would be eligible for a tiered pay raise based on length of service. District and county attorneys are also included in the bill and are eligible for certain pay raises.

The bill now heads to the Senate. Sen. Joan Huffman (R-Houston) is the author of the companion legislation in that chamber.

Sheriffs’ Priority Legislation Passes

SJR 32 by Sen. Brian Birdwell (R-Granbury), a proposed constitutional amendment supported by county sheriffs to authorize a county or political subdivision to transfer a law enforcement dog, horse or other animal to its handler or another qualified caretaker upon the animal’s retirement or in the animal’s best interest has been finally passed by the 86th Legislature.

The proposed amendment will now go to voters for approval at the Nov. 5, 2019 election. If voters approve, sheriffs’ offices and police departments may retire law enforcement animals when they are no longer capable of performing their duties. Their goal is to place these animals with qualified persons, who are able to properly and humanely care for them once their service to the department is complete. Their likely placement would be with the animal’s former handler or other officers. Other eligible persons may include county jailers, tele-communicators, and other persons who are capable of humanely caring for the animal.

Disaster Funding

HB 4279 by Rep. Garnet Coleman (D-Houston) creates the Texas Disaster Mitigation, Recovery, Response and Infrastructure Grant Program to provide financial assistance to political subdivisions and the state for certain disaster mitigation and recovery projects. The bill, and the corresponding HJR 114, authorize the Texas Water Development Board to issue up to $10 billion in general obligation bonds and use the proceeds from the sale of the bonds to provide funding for the grant program.

Oldham County Judge Don Allred and Trinity County Commissioner Tiger Worsham (pictured with Chairman Coleman) testified to the merit and need for the legislation when it was considered in the House Natural Resources Committee on April 30. The bill and related proposed constitutional amendment were left pending.

Taxing Unit Appraisal Challenges

SB 955 by Sen. Paul Bettencourt (R-Houston) would amend the Tax Code to remove the ability of a single taxing unit to challenge the level of appraisals of any category of property in the district before the appraisal review board. The bill’s proposed removal of this challenge by taxing units could create a cost to local taxing entities and to the state through the school finance formulas.

While challenges by a taxing unit are rare, Sen. Bettencourt indicated the bill is in response to certain actions taken by the City of Austin. The bill passed the Senate in late March and was heard in House Ways and Means on May 1. It was left pending.

In Case You Missed It: State Budget Items of Interest to Counties

TAC has prepared a worksheet comparing the House and Senate versions of HB 1, the proposed state budget for the 2020-2021 biennium, to assist TAC members in monitoring items of importance in HB 1. This comparison includes items in Article XI, the so-called wish list article, consisting of items that either chamber may choose to fund should additional funds become available. The worksheet also includes items funded through SB 500, the supplemental appropriations bill.

86th Session Dates of Interest and Deadlines

With less than 30 days remaining in the 86thSession it is important to review several critical dates that are quickly approaching. For instance, May 9 is the last day for the House to consider second reading House bills and House joint resolutions on the daily or supplemental calendar.

If a bill does not advance according to these deadlines, the bill can no longer be considered and dies. See this Calendar and these Dates of Interest, which outline these deadlines in further detail.

Helpful Tracking Links for Legislation

- County Bills by Office as tracked by the Texas Association of Counties.

- Senate and House committee postings are available on Texas Legislature Online.

- MyTLO section of Texas Legislature Online – use it to create customized alerts for specific committee meetings or to track specific bills.

Source: Texas Association of Counties