Thought SB2 Would Help Lower Your Property Taxes? Doesn’t Look Like It. SMTX City Council To Consider 8 Percent Tax Rate

By Terra Rivers | Managing Editor

On Tuesday, the San Marcos City Council will consider a resolution directing the Interim Director of Finance to calculate the voter-approval tax rate in the manner provided for a special taxing unit by using an 8 percent threshold for revenue.

Senate Bill 2 establishes a percentage limit on what a taxing entity (city, county, school district, etc.) in Texas can raise property taxes every year.

With the implementation of SB 2, taxing entities must seek voter approval of a tax rate with a tax increase of more than 3.5 percent.

Previously, taxing entities were required to seek voter approval for a tax rate that raised taxes more than 8 percent.

However, the law does allow a city, county or taxing entity to “direct a designated office or employee to calculate the voter-approval tax rate,” formerly known as the Rollback Tax Rate, “of the taxing entity in the manner provided for a special taxing entity if any part of the taxing unit is located in an area declared a disaster area.”

Since the COVID-19 pandemic hit, all of Texas has been under a disaster declaration while state and local government leaders have struggled to contain the virus.

According to the agenda, the proposed resolution would allow the city to exceed the 3.5 percent cap but not exceed 8 percent.

The city’s tax rate for FY 2019 and 2020 of .6139 per $100 of valuation is within the 8 percent limit, and no increase to the prior tax rate is recommended.

The agenda states a preliminary estimate reflects a $1.5 Million difference in property tax revenue between 3.5 percent cap and 8 percent and that the average homeowner ($230K value) would see their annual tax bill increase approximately $100 using the current tax rate of 0.6139.

Governor Greg Abbott has discouraged local governments from raising property taxes to compensate for the revenue lost during COVID-19, but it hasn’t stopped some cities from considering it.

In Dallas, a resolution to seek voter approval to raise taxes in order to compensate for a shortfall of between $73 and $134 Million in revenue failed 11 to 3 by Dallas City Council members.

According to city staff, the city of San Marcos is projected to experience a $6.4 million shortfall in revenue due to the COVID-19 economic shutdown. The council directed staff in April to begin work on finding areas where cost reductions can be made to compensate.

However, Gov. Abbott instructed all state agencies and universities to cut 5 percent across the board from their current and upcoming budgets due to the economic havoc that COVID has caused.

During a budget workshop on May 26, staff provided Council with an update on efforts to find areas where the city could reduce costs.

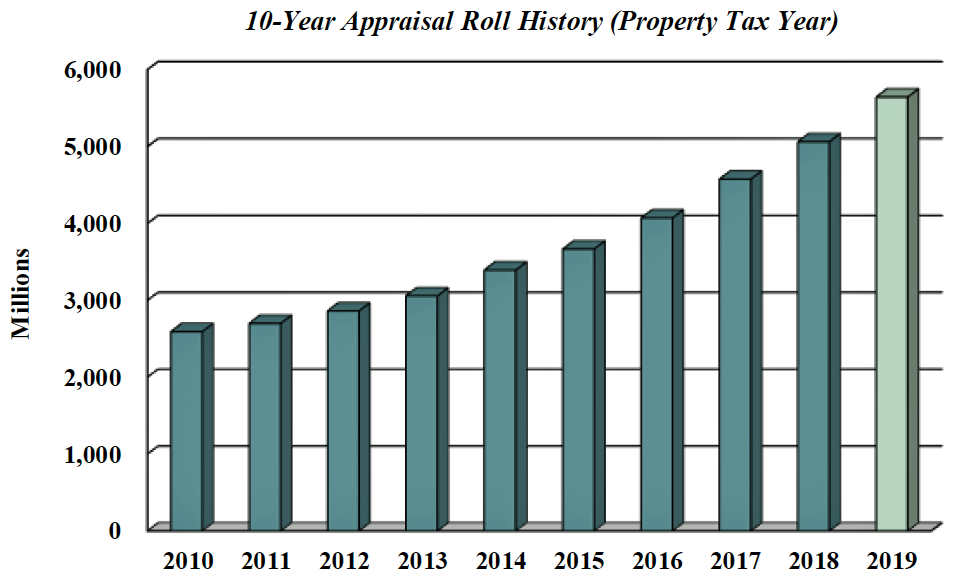

According to the City of San Marcos FY 2020 Budget, which totals $239 Million, “property tax appraisals have increased by 11 percent for FY 2020, and the city is seeing indications of continued growth for the future with the addition of residential developments, business growth, and continued economic development opportunities.”

According to the City of San Marcos FY 2020 Budget, which totals $239 Million, “property tax appraisals have increased by 11 percent for FY 2020, and the city is seeing indications of continued growth for the future with the addition of residential developments, business growth, and continued economic development opportunities.”

The average home value for the tax year 2019 was $208,000, an increase of $13,000, or 6.7 percent from the tax year 2018, the budget states; sales taxes were projected to comprise 44.4 percent of FY 2020’s General Fund’s total revenue.

The city’s total budget for FY 2020 was $239 Million; thus far, city staff has identified a total of $4,644,086 in cost reductions through the FY20 General Fund; an employee innovation box is under review for additional reductions of $856,086.

Additionally, the FY 20 budget, sales taxes represents 44.4 percent of the total general fund revenue projected for the fiscal year 2020. “Sales tax receipts are the largest single revenue source supporting general governmental services in San Marcos.”

The council aims to reduce costs by $5.5 Million and make up the remaining $900,000 through a utility franchise fee increase from 7 percent to 8 percent.

City staff is recommending the council adopt the same tax rate of 0.6139 from the last few years.

Assistant Director of Finance, Melissa Neel, said if the city were to adopt the 3.5 percent No-New-Revenue (effective) tax rate, its budget would experience an additional $1.5M shortfall in revenue on top of the deficits caused by COVID-19.

If the city decided to follow Governor Abbott’s budget cost-cutting measures, the city would have to cut $11.9 million.

The resolution is posted as part of the council’s consent agenda (#16) and may pass without discussion.

The San Marcos City Council will convene virtually for their regular meeting at 6:00 PM.

Those interested in submitting public comments must submit them to the City Clerk’s office by 12:00 PM on the day of the meeting, June 2.