National Cyber Tip Line Leads To Arrest Of Williamson County Man On Multiple Counts Of Child Pornography

A CyberTipline report from the National Center for Missing and Exploited Children (NCMEC) alerted the Texas Child Exploitation Unit to Williamson County man leading to five counts of possession of child pornography…

![]()

Child Exploitation Unit Arrests Williamson County Man for Possession of Child Pornography

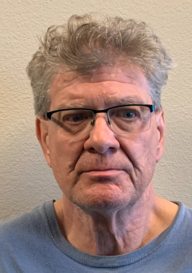

AUSTIN – Attorney General Ken Paxton today announced that the Child Exploitation Unit of his office arrested 66-year-old Charles Andrew Adler, of Leander, Texas, on five counts of possession of child pornography, a third-degree felony.

A CyberTipline report from the National Center for Missing and Exploited Children (NCMEC) alerted the Child Exploitation Unit to Adler, who was reportedly uploading images of child pornography to an email account.

While executing a search warrant at Adler’s home, investigators found numerous images of child pornography on his cell phone. During an interview, Adler confessed to uploading and storing files of child pornography on his cell phone. Investigators seized items for examination by the Digital Forensics Unit of the attorney general’s office.

Attorney General Paxton’s office works to protect children by using the latest technology to track down some of the most profoundly evil predators online. Since its inception, the Child Exploitation Unit has made 325 arrests and obtained 580 convictions on charges for possession of child pornography.

Attorney General Paxton urges all parents and teachers to become aware of the risks children face on the internet and take steps to help ensure their safety.

If you suspect someone is producing or downloading child pornography you can report it to NCMEC.

For more information on cyber safety, please visit: https://texasattorneygeneral.gov/initiatives/cyber-safety/.

![]()

Hails Supreme Court Decision Upholding States’ Rights to Prosecute Criminals

AUSTIN – Attorney General Ken Paxton today commended the U.S. Supreme Court’s decision upholding its longstanding view on states’ rights to prosecute criminals. During oral argument last December, Attorney General Paxton, leading a bipartisan coalition of 36 states, urged the high court to leave the current system in place.

The Supreme Court ruled that a person can be prosecuted for the same criminal conduct in state and federal courts without violating the Constitution’s Fifth Amendment double jeopardy principles because the two systems operate as separate governments. Lawyers for an Alabama man wanted the high court to overturn its previous decisions recognizing the longstanding “separate sovereigns” doctrine.

“For over 170 years, the Supreme Court has recognized repeatedly that if someone violates state and federal law, both governments can prosecute,” Attorney General Paxton said. “The Supreme Court’s latest decision recognizes the original intent of the framers of the Constitution, who regarded the states and the federal government as equals in carrying out justice separately. Importantly, the high court’s ruling preserves federalism, allowing state and federal governments to continue pursuing their own interests without interfering with each other.”

When Texas filed a friend-of-the-court brief with the Supreme Court last November, it was joined by 35 other states – including the 15 most populous – representing, collectively, more than 86 percent of the U.S. population: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Iowa, Kansas, Louisiana, Maryland, Massachusetts, Michigan, Montana, Nebraska, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Utah, Vermont, Virginia, Washington, West Virginia and Wisconsin.

View a copy of the U.S. Supreme Court decision here.

![]()

Texas ITT Students Receive $13 Million In Debt Relief In Multistate Settlement

AUSTIN – Attorney General Ken Paxton today announced a $13 million debt relief agreement for 1,430 former ITT Tech students in Texas as part of a 43-state settlement with Student CU Connect CUSO, LLC. Nationally, the settlement will result in debt relief for more than $168 million for more than 18,000 former ITT Tech students.

CUSO offered loans to finance students’ tuition at the failed for-profit college, ITT Tech, which filed for bankruptcy in 2016 following action by the U.S. Department of Education to restrict ITT Tech’s access to federal student aid.

ITT Tech, with CUSO’s knowledge, offered new enrollees temporary credit in order to cover the gap in tuition costs between federal student aid and the full cost of their education. Although most students believed that like with federal student loans the temporary credit was due to be paid six months after their graduation, ITT Tech demanded the credit be paid back the following academic year. When students could not repay their credit on short notice, ITT Tech pulled students out of class and threatened to expel them in order to coerce students into accepting high-interest loans from CUSO.

“Students who attended ITT Tech are burdened with unpayable debts they received while pursuing an honest education. This college and loan program have failed them tremendously,” Attorney General Paxton said. “I am proud of my office for holding CUSO accountable for their abusive loan practices and aiding students who were pressured into signing a loan without knowledge of the full cost or deadlines.”

Neither ITT Tech or CUSO made students aware of the true cost of temporary credit repayment until it was converted into a loan. Unsurprisingly, the default rate on the CUSO loans was projected to exceed 90 percent due to high costs and lack of success ITT graduates had getting jobs with their earned degree. The defaulted loans continue to affect students’ credit ratings and are usually not dischargeable in bankruptcy.

Under threat of litigation, CUSO agreed to forego collection of the outstanding loans, supply credit reporting agencies with information to update students’ credit information and cease doing business. CUSO’s loan servicer will also send notices to borrowers about the cancelled debt and ensure that automatic payments are ended. Students will receive mailed notices with information about their rights under this settlement.

View a copy of the settlement here.

![]()

Request for Opinion

Original Request RQ-0291-KP: County authority and responsibility for stray livestock

Received: Friday, June 14, 2019

Requestor: The Honorable Poncho Nevarez

Chair, Committee on Homeland Security and Public Safety

Texas House of Representatives

Post Office Box 2910

Austin, Texas 78768-2910

![]()

Notification of Opinion

Original Request RQ-0262-KP : Whether an arbitration decision binds the Manufactured Housing Division of the Texas Department of Housing and Community Affairs with respect to payment amounts under the Manufactured Homeowner Consumer Claims Program (RQ-0262-KP)

Opinion Summary KP-0258: The Manufactured Housing Division of the Department of Housing and Community Affairs administers the Manufactured Homeowner Consumer Claims Program (“Program”), provided for in Occupations Code chapter 1201, which provides relief to certain consumers of a manufactured housing licensee. In establishing damages for the consumers, subsection 1201.405(e) provides that the director of the Program shall make an independent inquiry into the amount of damages actually incurred, “unless the damages have been previously established through a contested trial.” A court would likely conclude that neither an arbitration nor a judicial confirmation of an arbitration judgment is a “contested trial” within the scope of subsection 1201.405(e).

Subsection 1201.404(a) limits payments from the Program to violations of specified rules or statutes. Even were a judicially confirmed arbitration award to constitute a contested trial under subsection 1201.405(e), an arbitration judgment cannot bind the Program for payment of a claim that is outside the statutory limits of the Program. However, such an award could serve as supporting evidence for the director to consider in determining actual damages for a claim within the scope of the Program.

![]()

Notification of Opinion

Original Request RQ-0261-KP: Whether a private attorney or collection agency that contracts with a county to collect delinquent amounts owed to county courts may charge defendants a fee for the use of credit cards (RQ-0261-KP)

Opinion Summary KP-0257: Section 604A.0021 of the Business and Commerce Code prohibits imposing a surcharge for the use of a credit card in certain instances. Although a recent judicial decision held section 604A.0021 unconstitutional as applied to specific facts, it remains enforceable in some contexts. But it does not apply to a county imposing a surcharge on a payee using a credit card for the payment of money owed to the county.

Section 103.0031 of the Code of Criminal Procedure authorizes a county to contract with a private attorney or a public or private vendor for the provision of collection services for fees. If a county is entitled to impose a surcharge fee for credit card use, a court would likely conclude that a private attorney or collections agency acting as agent for the county could collect that surcharge on behalf of the county when collecting other fees, taxes, or other charges.

![]()