Hays County, local municipalities receive over $6.5 million in combined April sales tax revenue, down from last month

Corridor Staff

Hays County, local municipalities received over $6.5 million in combined monthly sales tax revenue for December. That’s down from March by $823,000.

According to the comptroller’s website, Hays County and the local government municipalities received $32,018,533.21 million combined total year to date (January-December) in sales tax revenue payments.

Sales taxes are a primary source of funds for many vital services ranging from police and fire protection to parks, recreation, library, environmental services, planning, and more.

The reliance on sales tax revenue requires vigilant monitoring of revenue sources to assure they will keep pace with the demands and rising costs while operating large complex budgets.

In the City of San Marcos, sales tax revenues represent 38.27% of the general fund budget and are the largest single revenue source supporting general government services and this is the same for nearly all cities across the state.

You can review more on the San Marcos budget, spending, and where your tax money goes below.

.

• MONTHLY COUNTY & MUNICIPAL RUNDOWN •

.

APRIL 2022 SALES TAX REVENUE

Local Central Texas Cities: $4,583,551.75

Hays County: $1,934,703.86

Combined Total: $6,518,255.61

These allocations are based on sales made in February by businesses that report tax monthly.

•

MARCH 2022 SALES TAX REVENUE

Local Central Texas Cities: $5,116,508.60

Hays County: $2,224,276.31

Combined Total: $7,340,784.91

*These allocations are based on sales made in January by businesses that report tax monthly.

COMBINED YEAR TO DATE SALES TAX REVENUE

Local Central Texas Cities: $22,313,596.57

Hays County: $9,704,936.64

Countywide Combined Total: $32,018,533.21

*Year To Date: January-December calendar year

• MONTHLY COUNTY & MUNICIPAL BREAKDOWN •

Can’t see the whole table? Touch it and scroll right!

| CITY | RATE | NET PAYMENT THIS PERIOD | COMPARABLE PAYMENT PRIOR YEAR | % CHANGE |

PAYMENT YTD | PRIOR YEAR PAYMENT YTD | % CHANGE |

| BUDA | 1.50% | $767,645.82 | $637,219.44 | 20.46% | $3,697,995.07 | $3,040,740.56 | 21.61% |

| DRIPPING SPRINGS | 1.25% | $279,072.43 | $232,221.38 | 20.17% | $1,341,627.92 | $1,152,395.95 | 16.42% |

| HAYS | 1.00% | $2,757.20 | $1,836.10 | 50.16% | $10,248.56 | $7,019.83 | 45.99% |

| KYLE | 1.50% | $995,369.43 | $732,787.22 | 35.83% | $4,621,615.47 | $3,608,327.18 | 28.08% |

| MOUNTAIN CITY | 1.00% | $1,705.07 | $1,383.65 | 23.22% | $8,431.21 | $7,339.73 | 14.87% |

| NIEDERWALD | 1.00% | $5,692.14 | $4,728.76 | 20.37% | $26,399.69 | $20,729.45 | 27.35% |

| SAN MARCOS | 1.50% | $2,383,792.12 | $1,833,623.53 | 30.00% | $11,893,103.52 | $15,860,252.58 | 25.01% |

| UHLAND | 1.50% | $47,351.92 | $37,833.71 | 25.15% | $235,754.61 | $174,363.11 | 35.20% |

| WIMBERLEY | 1.00% | $93,875.13 | $69,541.18 | 34.99% | $447,677.29 | $363,889.11 | 23.02% |

| WOODCREEK | 1.00% | $6,290.49 | $5,320.85 | 18.22% | $30,743.23 | $28,864.45 | 6.50% |

| HAYS COUNTY | 0.50% | $1,934,703.86 | $1,559,482.03 | 24.06% | $9,704,936.64 | $10,164,235.23 | 4.51% |

![]()

.

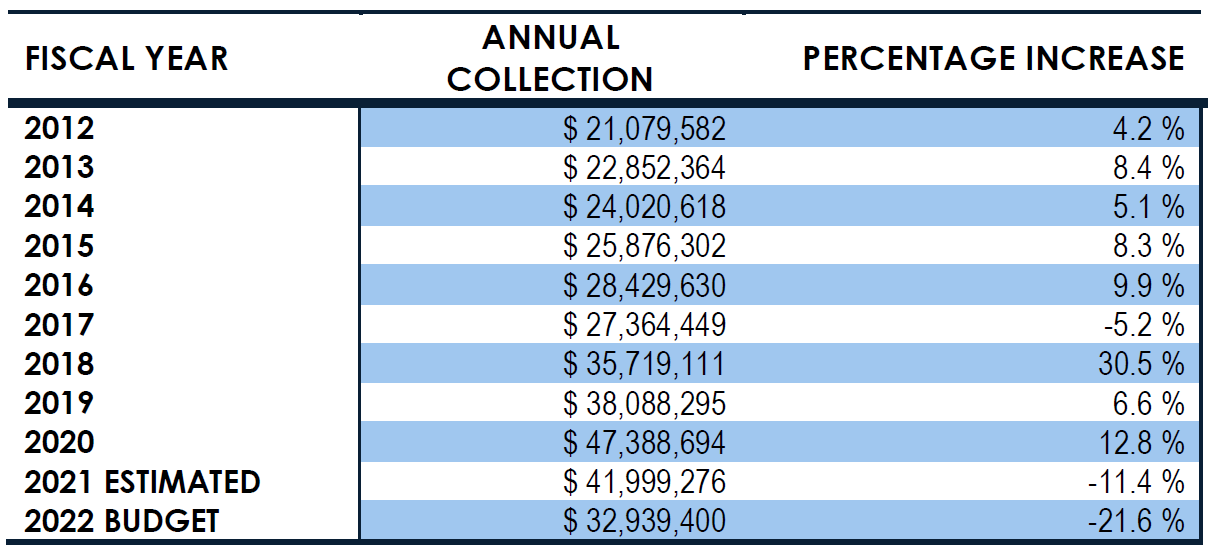

THE CITY OF SAN MARCOS 10-YEAR ANNUAL

SALES TAX COLLECTION & HOW IT’S USED

Sales taxes represent 38.27% of total General Fund revenue projected for fiscal year 2022.

Sales tax receipts are the largest single revenue source supporting general governmental services in San Marcos. Consistent retail sales have kept this revenue stream steady for the past several years.

When comparing historical sales tax collections by segment, the percentage represented by retail collections has decreased while other segments have increased, indicating a small diversification in the sales taxes produced in the City.

It is important to note that sales tax revenues are a volatile funding source and are subject to shifts in local, state, and national economies. Our reliance on this revenue source is approached with caution.

Any excess collection above the fiscal year 2022 estimate will go directly into the General Fund balance or the budget can be amended to allocate these amounts.

SALES TAX COLLECTIONS – 10 YEAR

.

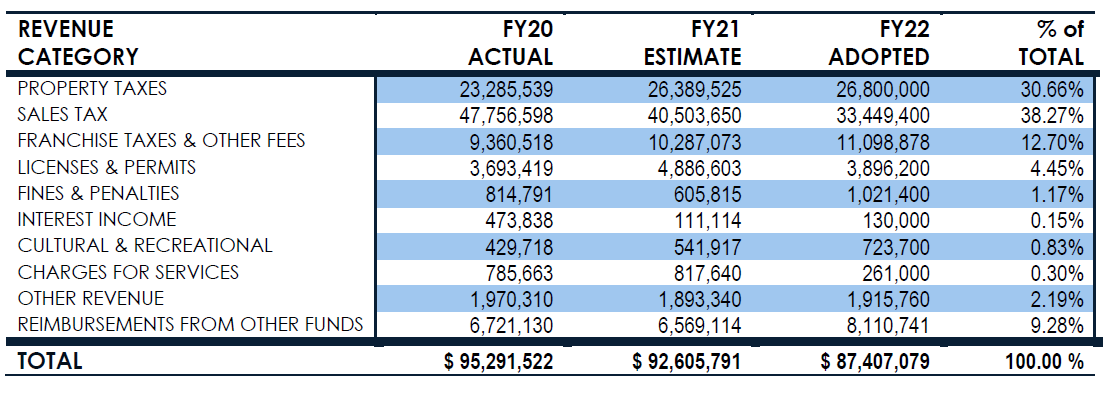

The City of San Marcos collects one and one-half cents on every dollar spent on taxable goods and services within the city limits.

The State of Texas allows home-rule cities like San Marcos to adopt a one-cent sales tax to support general governmental services.

Local voters authorized another half-cent in 1987 dedicated solely to the reduction of property taxes.

The one and one-half cents collected by the City represents the maximum they may adopt.

The half-cent sales tax alone is expected to generate $11,906,000 in the next fiscal year, a sum that is equivalent to 23.52 cents on the property tax rate.

According to the city, without the half-cent sales tax dedicated to property tax reduction, the city’s ad valorem tax rate would have to be 23.52 cents more, or 84.91 cents per $100 of assessed value, to support the programs and services provided to San Marcos residents.

.

GENERAL FUND REVENUE SUMMARY

![]()

.

![]()