Is The E-pocalypse Here?

Contrary to many assumptions, the increased popularity of online shopping does not obviate the need for brick-and-mortar stores. Consumers’ preference for the store remains strong.

![]()

CBRE, U.S. Research & Reports – Is The E-pocalypse Here?

By Spencer Levy, Melina Cordero, and David Egan

Executive Summary

- Despite recent headlines implying that e-commerce is rapidly eroding retail store sales, the fact is that more than 90% of retail sales still occur in physical stores.

- Online sales are not the exclusive domain of pure-play e-retailers, as more than 50% of online sales are made by brick-and-mortar brands.

- U.S. consumers prefer combining online and in-store shopping, making omnichannel platforms critical to retailer growth.

- To execute omnichannel effectively, most brick-and-mortar brands are restructuring industrial footprints and supply chain strategies to enable faster and more cost-effective delivery to consumers.

Perception

Recent headlines suggest that e-commerce sales are rapidly eroding those of retail stores, and that it’s only a matter of time until the industry is left with a post-brick-and-mortar landscape of vacant storefronts and abandoned malls—a phenomenon we call the “e-pocalypse.”Basic e-commerce data seems to support this narrative; e-commerce’s share of total retail sales reached 8.5% in Q1 2017, and the estimated share of GAFO sales (general merchandise, apparel & accessories, furniture and other) reached 23%.

Even more striking is the disconnect between online and physical store growth; between 2010 and 2016, e-commerce sales climbed at an average annual growth rate of approximately 15% vs. 4% for physical stores. The assumption is that this growing slice of the retail pie is going exclusively to the so-called “pure-play” e-retailers (retailers that operate exclusively online).

Reality

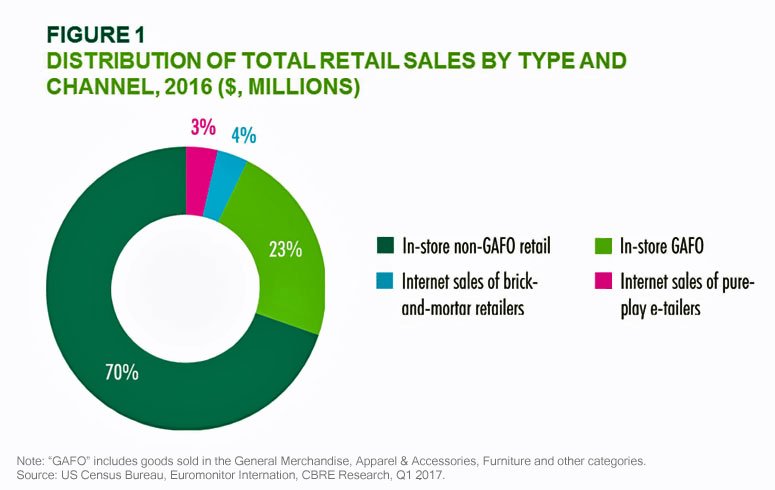

The impact of internet retail sales growth, though strong, is often vastly overstated. In reality, e-commerce accounts for less than 9% of total retail sales today, and is forecasted to not exceed 15% within the next five years. Figure 1 -This equates to $394 billion in online sales last year, compared with $5.5 trillion in total retail and food-service sales.

The common belief that internet sales primarily are by e-retailers and take share from storefront retailers is a major misconception. In fact, more than 50% of e-commerce retail sales last year were by brick-and-mortar brands. Pure-play e-retailers accounted for less than 4% of total retail sales.

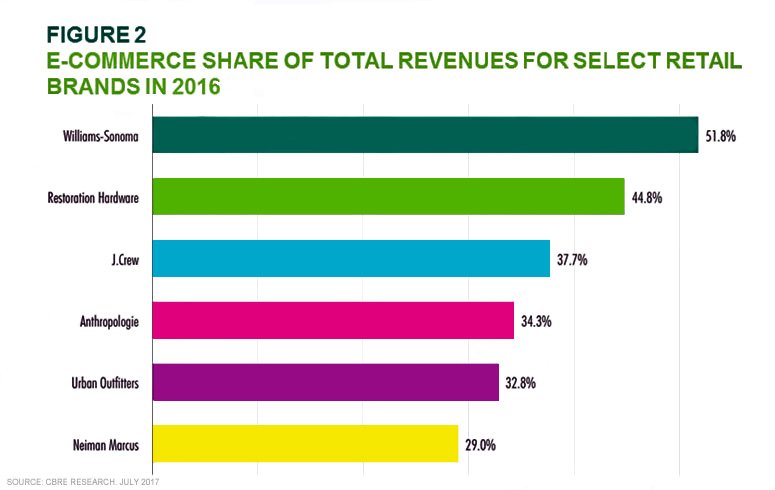

Traditional physical-store retailers have invested heavily in their online sales platforms over the past several years to meet rising consumer demand for omnichannel shopping. This has naturally led to growth in their e-commerce sales. Figure 2 shows several major brick-and-mortar brands’ e-commerce share of total sales in 2016, evidence of significant dependence on revenue earned online.

These figures indicate that physical retailers are adapting to and leveraging e-commerce sales to increase revenue. As a result, internet sales are adding—not taking—market share for traditional retailers.

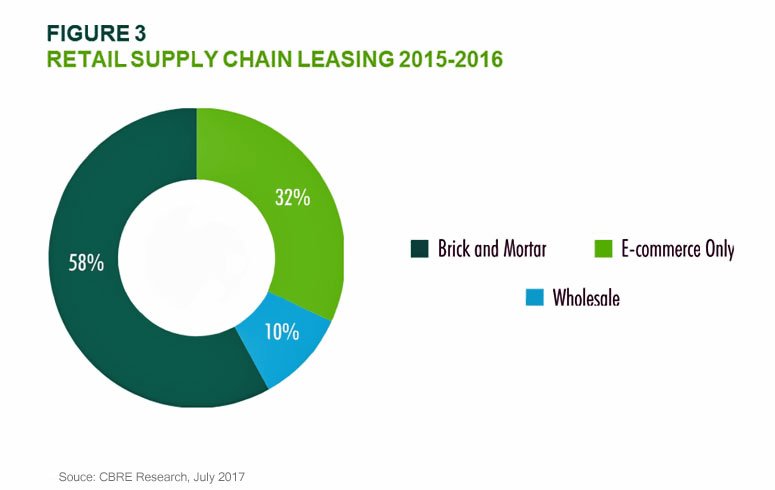

Further evidence of this adaptation can be found in the industrial & logistics sector. CBRE analysis reveals that brick-and-mortar retailers absorbed the majority (approximately 58%) of industrial real estate leased for the retail supply chain in 2015 and 2016. This fact belies headlines that suggest demand by pure play e-commerce players is surpassing that of traditional retailers. In fact, successful brick-and-mortar retailers have expanded their supply chains and added to their industrial real estate portfolios in response to the competition from online retail. This trend is expected to continue, as traditional brands restructure and expand their industrial footprints to meet increased fulfillment of online purchases.

For further analysis of e-commerce’s impact on industrial & logistics real estate, see CBRE’s recent studies of same-day speed and last-mile delivery.

Consumers Still Seek the Store

Contrary to many assumptions, the increased popularity of online shopping does not obviate the need for brick-and-mortar stores. Consumers’ preference for the store remains strong. Though internet shopping is tremendously popular (79% of U.S. adults shop online and 51% buy products using a phone), (figure 3) consumers are demanding omnichannel—the use of multiple channels for a single purchase—more than they demand pureplay e-commerce. Strikingly, 65% of e-commerce shoppers surveyed by the Pew Research Center explicitly stated that they preferred shopping in the store and online for a single product, as opposed to shopping solely online.

Increasingly, the industry is recognizing that physical stores and internet sales are not direct competitors, but instead are complementary. Several major retailers have stated that a store closure has a negative impact on internet retail sales in that market. Similarly, retailers have reported that opening a new store tends to drive up internet sales in that market.

This article was originally published by CBRE.

This article was originally published by CBRE.

For more information on this research project, please contact CBRE Head of Research, Americas | Senior Economic Advisor, Spencer Levy; Head of Retail Research, Americas, Melina Cordero; Head of Industrial & Logistics Research, Americas & Global, David Egan.

CBRE is a real estate services company with 30,000 U.S. professionals in 170 offices provide exceptional outcomes for clients by combining local market insight, broad services, specialized expertise and premier technology tools and resources.