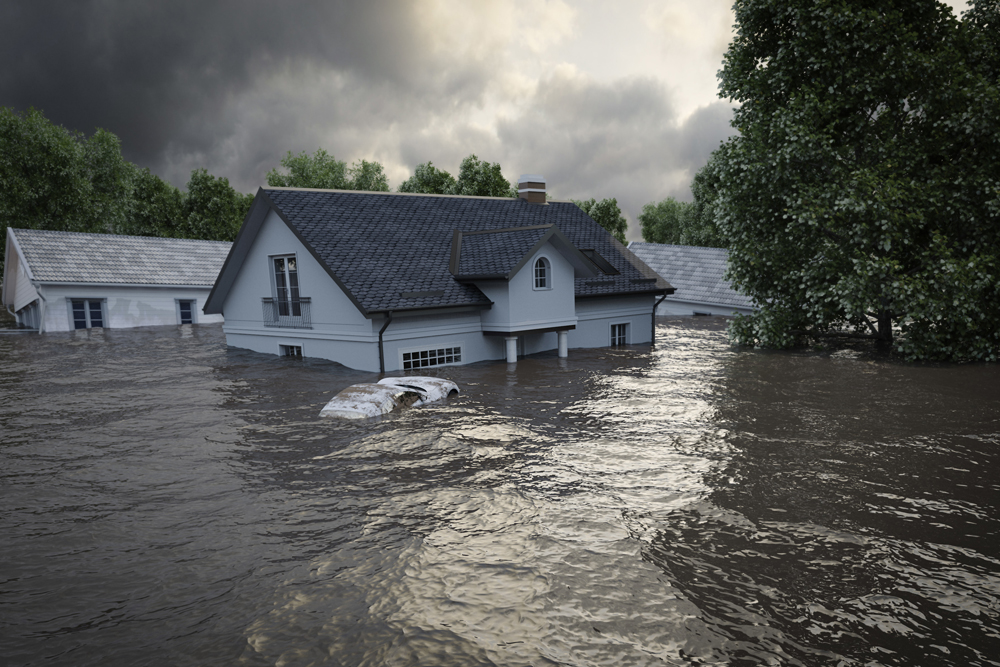

What Is Flood Insurance And Why Some Central Texas Homeowners Should Take A Serious Look At Buying

![]() Mother Nature has been busy this week and the east coast is getting hit extremely hard by Florence. Texas and Hays County is no stranger to to the wrath of Mother Nature and the rain she is…

Mother Nature has been busy this week and the east coast is getting hit extremely hard by Florence. Texas and Hays County is no stranger to to the wrath of Mother Nature and the rain she is…

![]()

Mother Nature has been busy this week and the east coast is getting hit extremely hard by Florence. Texas and Hays County is no stranger to to the wrath of Mother Nature and the rain she is currently dishing out, including today’s flood watch we are under until 7 PM today. Because of all this rain, we wanted to share some information from Robin Smith, FEMA Region 6 Public Affairs Administrator.

Who can purchase flood insurance

Anybody can purchase a flood policy on a residential structure, non-residential structure or condominium structure located in a community that participates in the National Flood Insurance Program (NFIP). Both homeowner’s AND renters may also purchase flood insurance for your contents.

Note: If your mortgage company requires flood insurance, be sure and inquire with your agent as to whether the coverage you purchased also covers contents! The mortgage company may not require that, but you will want it if you flood!

Approximately 31% of National Flood Insurance Program (NFIP) flood claims nationwide come from the minimal risk flood zones B,C and X, so EVERYBODY should consider their home is in a flood zone; it is just a difference of how much the risk is.

If you can see water from your house – even if it is simply rolling down the street – you should buy flood insurance to protect your home and belongings.

Need another reason?

Here is the definition of a flood from the perspective of the National Flood Insurance Program: Defined in the Standard Flood insurance Policy (SFIP) as a general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or two or more properties (at least one of which is your property) from overflow of inland or tidal waters, from unusual and rapid accumulation or runoff of surface waters from any source, or from mudflow.

This would also include sewage backup and seepage or leaks on or through the covered property if: There is a general condition of flooding in the area and the flood is the proximate cause.

Based on national statistics, over a period of a 30 year mortgage, 26% of people will experience a fire. Over 30% of people will experience a flood during a 30-year time frame.

An example of a flood insurance policy premium based on a Preferred Risk Policy: An NFIP Preferred Risk Flood Policy (PRP) can be purchased for as little as $148 per year depending on the amount of coverage that’s purchased.

A Preferred Risk Flood Policy with full coverage (both building coverage and contents coverage $250,000/$100,000) may cost as little as $450 per year. Check with your agent to find out about flood insurance to protect your home and contents.

Preferred Risk isn’t the only type of policy available. Check with your insurance agent or one who sells flood insurance to see what it would cost in your specific situation.

- Funds from insurance claim payments do not depend on a disaster being declared.

- Recovery after the loss is much faster if you have flood insurance, both for businesses and for residential homes.

- Don’t wait for disaster fund payments, disaster assistance is only for basic needs. (Examples of basic might include: the boards underneath your flooring, not your carpets, tile or hardwood flooring, since you can “basically” live in the house with just the boards; making sure you have one functional television if you lost yours in the flood, but replacement will be a basic model, not necessarily a replacement for your larger, fancier version.)

- Own your house already but don’t have flood insurance right now? Flood insurance policies generally have a 30-day waiting period.

- Buying a new house: There is no waiting period if a policy is purchased and premium is paid prior to closing of the loan.

- Selling a house: The policy can be assigned to a new owner when the home is sold if it’s done at the time of the closing.

- Need an agent: Call your car or homeowner’s agent or call the National Flood Insurance Call Center at 1-800-427-4661, or visit: https://www.fema.gov/national-flood-insurance-program.