Drivers Wanted: Texas trucking strives to stay on the move

By Jodi González

Trucks move 72 percent of U.S. domestic freight by weight, according to the American Trucking Associations (ATA). A commercial truck driver shortage across the nation has compounded supply chain problems, driving inflation, and experts have varying ideas on why it’s happening and how to tap the brakes.

Often, ATA is quoted for its statistic of an 80,000-driver shortage, and John Esparza, president and chief executive officer of the Texas Trucking Association (TXTA), says the shortfall is growing larger. “We will be at 160,000 at the end of the decade,” he says. “We are losing a generation of drivers, and we aren’t replacing them with a generation of potential drivers that is large enough.”

About 3.5 million truck drivers, with an average age of 46, are on U.S. roadways, according to the U.S. Bureau of Labor Statistics. By 2030, more than half of current truck drivers will have passed retirement age.

Texas Trucking Industry

Texas is home to almost 200,000 commercial truck drivers and leads the nation in this occupation (Exhibit 1). Truck drivers run different types of routes, from local to regional, intrastate to interstate (also called long haul or over the road). In a state the size of Texas, intrastate routes are plentiful, especially considering that 82 percent of Texas communities depend exclusively on trucks for needed products, according to TXTA.

To drive a “big rig” — or other vehicles with a set weight or passenger load — requires a commercial driver’s license (CDL). Texas has more than 100 CDL schools, some private and some offered at postsecondary institutions such as San Jacinto College in Pasadena.

Business is Booming

San Jacinto’s CDL classrooms are jam-packed, especially since the college steered Higher Education Emergency Relief Fund (HEERF) money it received through the federal Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, toward tuition assistance for students, including those on the CDL track.

Tony Rich, director of the college’s Applied Technology and Trades Department, says enrollment in the CDL program has jumped 250 percent from fall 2020 to fall 2021. “This became a godsend for some who were out of the workforce. They could come in and get training in five to six weeks without a financial burden.”

San Jacinto limits enrollment to 12 students per class because it has 12 available trucks for training. Demand has the college looking at ways to build its fleet capacity.

The school, however, is competing with the trucking industry, which also is trying to buy more trucks. Both the school and the industry face two challenges in their procurement efforts: Production of new diesel trucks is delayed due to supply chain shortages, and used trucks are scarce.

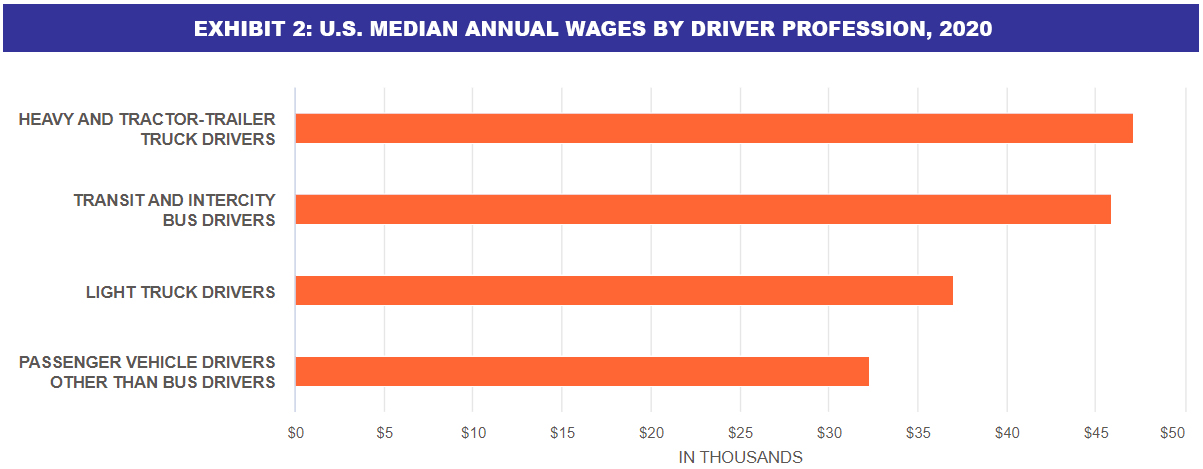

Starting a trucking career is a fast route to a paycheck, says Ken Tidwell, dean of the college’s Workforce Development program (Exhibit 2). “Median wage is $47,400 in our area, with starting wage a little bit lower than that. That’s why we see so many people who want to join the program. It is addressing a financial need for them right now.”

The limited capacity has created a sense of urgency for would-be truck drivers. “We are full through August,” says Rich. “Every seat is taken. When we open up a class, within 48 hours, it’s full. We expect to have about 144 [students] in the program this academic year.”

Source: U.S. Bureau of Labor Statistics, May 2020

Limited capacity has been an issue at driver’s license offices as well. The Texas Department of Public Safety (DPS) opened selected offices on some Saturdays in 2021 for CDL testing, and a pandemic waiver allowed driving schools to administer not only the skills tests allowed under a memorandum of understanding with DPS but also the knowledge tests.

That waiver expired May 31, 2021, but the Legislature passed House Bill (HB) 3395 into law, taking effect Sept. 1, 2021. The law allows other entities or people to administer both tests to relieve the DPS backlog.

Another new law aimed at increasing the number of drivers is HB 3606, which requires the Texas Department of Criminal Justice to allow a public or private entity to offer vocational training, including CDL training, to inmates.

It isn’t just students rushing through the doors. Recruiters come calling often, Rich says. Some students are offered jobs right away, contingent on them successfully finishing the program, he says. And 90 percent of those who sign up to earn their CDL finish the job.

Realities of the Job

Despite the number of people clamoring to start a trucking career, there remains a shortage. The reasons are complex, but most roads lead to an issue of retention.

“Some [companies] have 100 percent turnover, and that’s terrible,” says TXTA’s Esparza. “The demands on the driver and the fact that they can easily make six figures in the world today, that’s an amazing number to think about. It speaks to the importance of driving trucks. They are the linchpin in the links of the supply chain.”

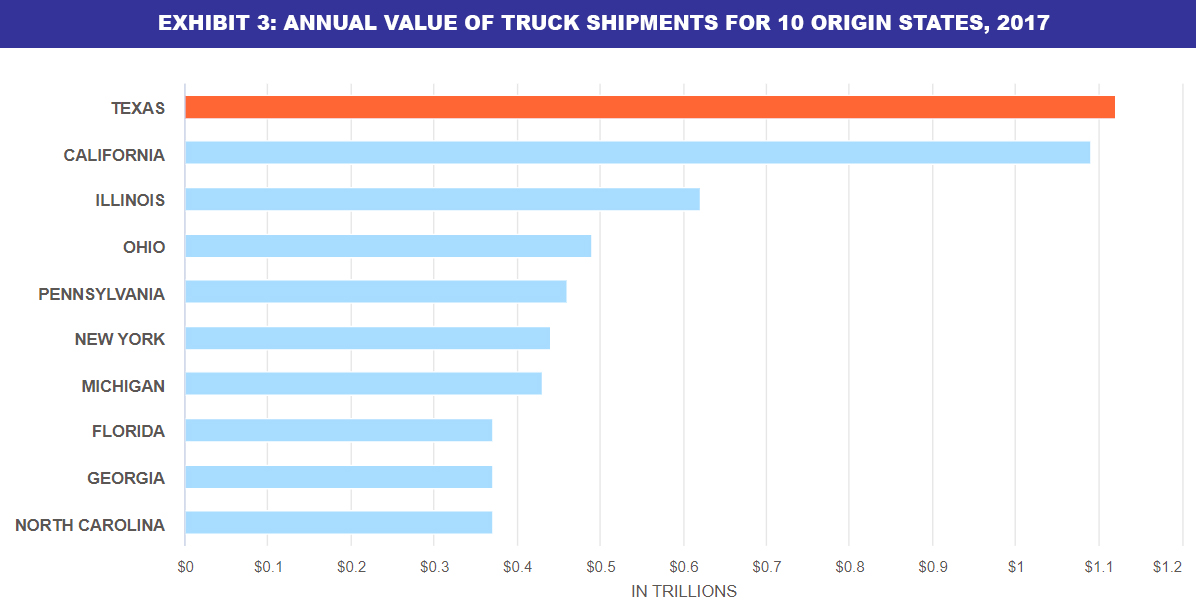

The numbers bear out the importance of trucking to the supply chain. Texas alone has transported goods worth more than $1.1 trillion out of state (Exhibit 3).

Before the pandemic, around 90 percent of people who started a trucking career would leave the industry, he says.

Drivers frequently cite poor treatment by employers as a reason for leaving, but there is no getting around some of the realities, especially in long-haul work. “It is a grueling, hard job,” says Tidwell. “It’s hard on families. It’s hard on relationships.”

Indeed, interstate truck drivers can be away from home for weeks at a time. And for a portion of that time, some of them aren’t compensated.

Many drivers are paid by the mile as independent contractors, so when they aren’t adding miles to the odometer, they can’t charge the employer.

Federal law restricts a truck driver’s driving hours regardless of the miles traveled. So if drivers hit traffic or weather and aren’t moving, their hourly rate drops.

San Jacinto’s CDL program doesn’t turn out a lot of licensed CDL drivers who wind up with a career in long hauls. “It’s still there,” says Tidwell, “but a lot of what we are getting is, ‘We need lorry drivers [short haul] taking things from the [Port of Houston].’ These drivers have a regular shift and go home when they are done for the day.”

Sitting on the Docks

The pay structure for long-haul drivers produces incomes that are much lower than many new truck drivers anticipate.

With COVID, the unpaid wait time has become an even bigger issue as trucks have idled for hours while waiting to pick up freight at the nation’s ports.

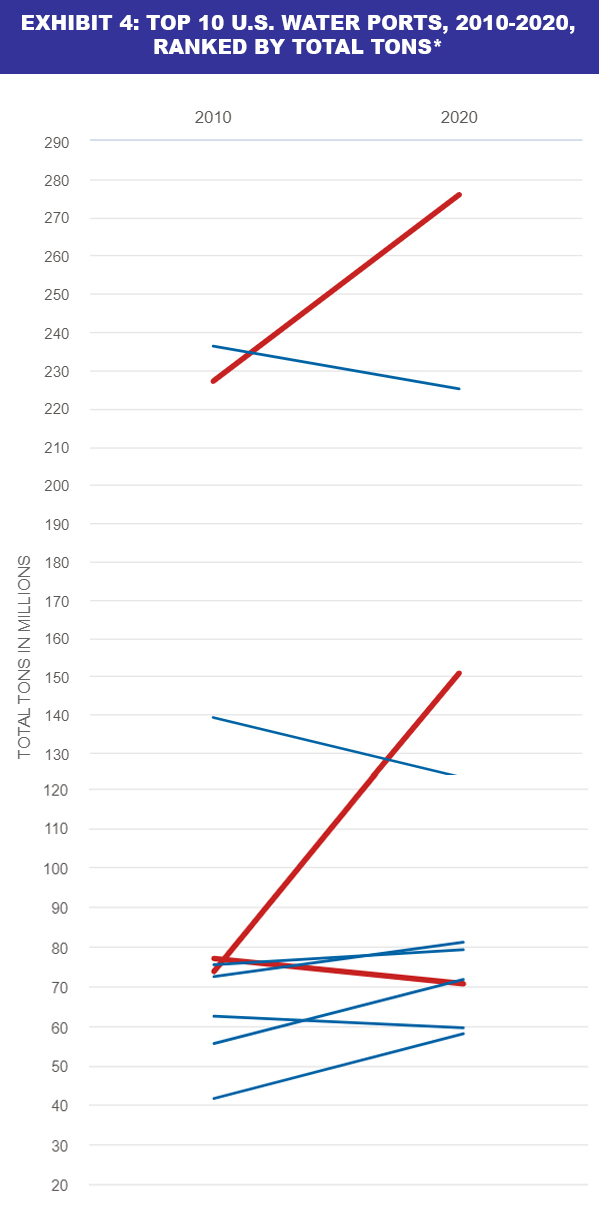

Media attention has focused on a backlog of ships waiting to unload their wares, the enormous tonnage moving through the nation’s top ports (Exhibit 4), and the ripple effect the backlog has had on the U.S. supply chain.

Tidwell says the reality of the supply chain dynamic is more complex.

“If you get a truck in, you have to hope that no one is sick on the cranes,” he says. “It’s having the right bodies, at the right time, in the right place to make it all work. Before COVID, those in the industry understood how small the margins were across the whole supply chain. COVID messed that all up.”

Esparza points to unrealistic expectations as a reason for the backups. “They want a level of commitment for people to work on Saturday if they are going to open a Saturday gate,” he says. “Just because the gates are open from 7 a.m.-6 p.m. doesn’t mean you have enough people working those docks to move those containers. It’s a fickle environment that can turn on a dime.”

Such frustration makes it difficult to hold on to those drivers. “We are our own worst enemy,” Esparza says. “[Some] segments of trucking will take drivers from other segments of trucking that perhaps are not as efficient. It’s a huge challenge.”

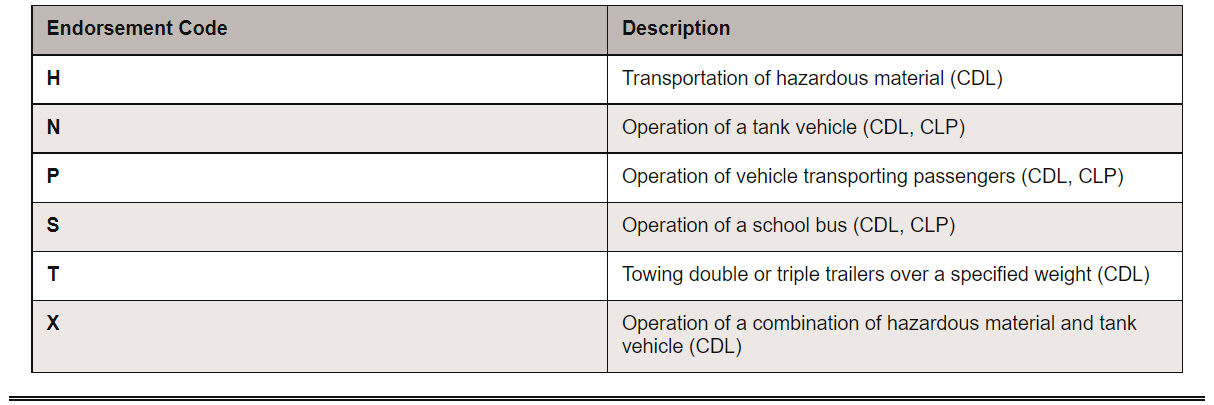

ENDORSEMENTS AND SPECIAL REQUIREMENTS

According to DPS, an endorsement listed on a CDL allows the license holder to operate certain types of commercial vehicles and transport specific items. Extra testing is required to earn these endorsements and having them gives the driver a broader range of job options, such as the ability to haul hazardous material and the opportunity for higher pay.

CDL holders doing short-haul driving from a seaport to a warehouse or other freight station also must have a federally mandated Transportation Worker Identification Credential.

For some endorsements, the prospective license holder is required to hold a commercial learner permit (CLP) for that endorsement for a minimum of 14 days before it can be added to a CDL.

Other Roadblocks

Esparza says labor shortages currently represent trucking’s biggest problem but cites other challenges as well — like what he pegs as “frivolous lawsuits” and changes to training.

Lawsuits “are driving companies out of business,” he says. “If we are triaging the trucking industry today, you are prioritizing the companies that are going out of business because their insurance is doubling and tripling overnight in annual renewals at a time when they don’t even have an accident on their record.”

Lawmakers addressed this issue during the 87th Legislature. HB 19 allows a trial against a carrier to have two phases: The first addresses only the crash at issue, and a determination of whether the carrier is grossly negligent in that crash. A second phase can include all evidence related to the carrier’s operations.

On the training side, Esparza says a 2016 federal change to skills tests reduced the availability of test sites. The change effectively added pieces to the skills test, he says, and reduced what were 200 available testing locations to about 25. There were two-month waits to get CDLs, and unfortunately, two months down the road, potential drivers already might be working elsewhere.

For all the complexities of trucking issues today, the job remains appealing to many, Tidwell says. “If you are looking for and need a job that is going to pay a family-supporting wage, truck driving is one of the best options out there. I can’t say you will be in it for 20 years, but there is no better program out there that can do that.”

Automation on the Horizon?

The industry is exploring automation as one way to fill the gap between drivers needed and drivers available. “Texas is leading the way in its application,” says Esparza. “[Automated trucks] are already on Texas roads.” As an example, one major shipping company is using partially automated trucks along Interstate 45 between Dallas and Houston.

“Someone is in the back of the cab, monitoring the systems, but in the next couple of years, that person won’t be there,” says Esparza. “It will be touchless. It’s a part of the solution to the driver shortage.” FN

Source: State of Texas Comptrollers Office

I didn’t notice anything mentioned in your article about the new federal regulation of the ELDT online course training and mandatory BTW training that was implemented on February 7, 2022.

I have been trying to get my CDL since January 2022 (long story short). Had an appointment on Feb. 3, 2022 (snowed – everything was shut down), called on the 4th to make sure TX DPS was open (even though the weather was clear and dry) – they were closed due to inclement weather.

On the 7th, went back into DPS, I had to redo my application due to the fact of this new mandate (that DPS knew nothing about prior to this date as I had asked several employees about it).

I have my CLP, but I think that is going to expire because I cannot afford to take off work 4 days a week for 6 weeks AND pay $3,000.00 for a BTW course.

Who thought up this new regulation in a day that we already don’t have enough CDL drivers?