Latest Economic Numbers For Texas Border

![]() Economic growth slowed along the border as hiring moderated, though unemployment remained historically low. Wages, however, failed to improve despite the tight labor market…

Economic growth slowed along the border as hiring moderated, though unemployment remained historically low. Wages, however, failed to improve despite the tight labor market…

October 2018 Border Summary

Economic growth slowed along the border as hiring moderated, though unemployment remained historically low. Wages, however, failed to improve despite the tight labor market, weighing on the housing market through decreased affordability.

Construction values elevated, but lackluster permit activity suggests flattening in the upcoming months. The trade outlook improved following the announcement of the U.S.-Mexico-Canada Trade Agreement (USMCTA).

The pact calmed concerns of supply-chain disruptions and overall operating uncertainty, strengthening the value of the peso. Current trade continues under the North American Free Trade Agreement until the USMCTA is approved by all three governments’ legislatures next year.

Economy

Economic activity moderated in the Texas border metros according to the Dallas Fed’s Business-Cycle Indices. A reduction in the workforce and in earnings lowered the McAllen index to 3.7 percent on a seasonally adjusted annualized rate (SAAR) after reaching a three-and-a-half-year high in July.

Brownsville’s index decelerated to 4.3 percent growth amid decreased hiring and lagging wages. The El Paso index remained optimistic at 3.7 percent, propelled by payroll expansions. Laredo’s index, however, flattened amidst negligible employment growth and falling wages.

Total border construction values picked up after a slow second quarter as both residential and nonresidential projects broke ground. Apartment activity in El Paso increased, elevating otherwise stable residential values.

All metros supported single-family construction values, but multifamily values stagnated in all but El Paso. The West Texas metro’s library/museum and hospital investment boosted nonresidential values. However, slowing school construction momentum and stagnant retail and office buildings values weighed on progress.

Nonfarm employment accelerated to 1.9 percent SAAR, adding nearly 14,000 jobs year to date. El Paso led the border, reaching 3.2 percent growth amid gains in the mining/logging/construction and professional/business services industries. Growth in the Rio Grande Valley flattened as Brownsville and McAllen shed 100 and 400 jobs, respectively.

Both metros contracted in education and health services, reversing more than half of third-quarter expansions. Laredo posted a slight uptick in jobs as hiring in the leisure/hospitality industry increased. However, reductions in the goods producing sector slowed improvement.

Manufacturing and maquiladora employment1 posted 12,550 job gains in the third quarter after a slow start to summer. Juarez added 3,800 jobs in September after a year-long stagnation.

Reynosa was the next largest employer as the workforce expanded by 1,900. Employment in Matamoros and Chihuahua continued to grow for the third consecutive month. Nuevo Laredo was the exception, shedding 500 jobs but registering 8 percent YTD growth.

Steady hiring held unemployment rates around historical lows. Joblessness in Brownsville and McAllen balanced at 5.7 and 6.3 percent, respectively. El Paso reached a record low of 4.1 percent as employment growth perpetuated for the sixth straight month.

Amid a slight increase in hiring, Laredo matched the state’s lowest unemployment rate since the series began in 1976 at 3.7 percent.

Despite tightness in the labor market, real private hourly earnings remained low across the board. El Paso reversed all gains since the start of the year whereas Laredo and McAllen fell 6.3 and 1.3 percent YOY, respectively.

Brownsville led growth at 8.5 percent YOY. Local wages, however, lagged almost $10 behind the statewide average after a four-year slide that ended last fall.

Improvements in the U.S.-Mexico trade outlook pulled the real peso-per-dollar exchange rate to a three-year low at 18.3. The stronger peso boosted U.S. export activity, bumping the total value of trade passing through the border metros up 1.7 percent.

El Paso and McAllen reached 4.7 and 5.5 percent YTD growth in trade values, respectively, while Brownsville hit an all-time high.

Laredo extended a two-month stagnation but remained the primary trade hub, comprising 63 percent of trade flows along the Texas border. The new U.S.-Mexico-Canada Trade Agreement provides stability to trade-related activities, which remain an integral component to the border economies.

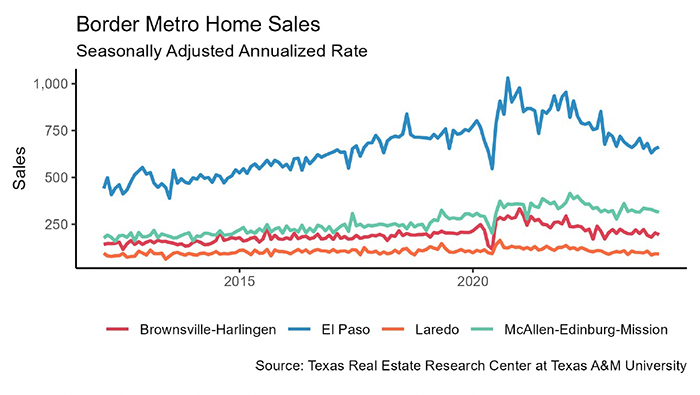

Housing

Border housing sales rose 4.2 percent in October after a sluggish summer. Transactions corrected upward in Laredo after falling in the third quarter with homes priced $100,000-200,000 dominating the market. Sales in Brownsville increased for the second straight month, gaining momentum in the $300,000-$500,000 price range.

In El Paso, expanded inventory levels for homes priced below $200,000 contributed to increased sales transactions, breaking a two-month contraction. McAllen was the exception as activity flattened, remaining below 2017 levels.

Single-family housing construction permits partially recovered September’s losses but remained almost 80 below this year’s average. The overall trend remained flat in Laredo and the Rio Grande Valley with minor fluctuations over the past five years.

El Paso, however, extended a two-year decline. Private single-family construction values closely tracked permits with Laredo and McAllen plateauing while values in Brownsville and El Paso continued to fall.

The months of inventory (MOI) of homes for sale varied across the border metros. The Laredo MOI sank to 4.9 months, a 2018 record low. El Paso inventories, on the other hand, broke a ten-month contraction, balancing at 4.2 months.

The Rio Grande Valley, already elevated above the other border metros, ticked up to 8.6 and 8.2 months in Brownsville and McAllen, respectively, due to an increase new listings.

The average number of days on market (DOM) decreased along the border. Laredo’s DOM dropped for the third consecutive month, setting at 57 days. The DOM in El Paso and McAllen dipped to 95 and 78 days, respectively, after third quarter increases.

Brownsville’ DOM remained elevated above the other border metros at 114 days due to steady activity at the upper-end of the market where homes typically take longer to sell, but persists under the long-run average of 132 days.

Differences in the distribution of housing sales and supply of listings accounted for most of the median price fluctuations. An inflow of new listings priced above $100,000 in El Paso eased supply constraints, pulling the median down to $151,700. However, the overall trend prevailed upward.

The median home price in McAllen continued to decline amid ample supply, reaching its lowest level of the year at $139,700. In contrast, increased transactions in homes priced above $200,000 elevated the price in Brownsville to an all-time high of $150,300.

The price in Laredo fell to $163,300 after a record high in September but continued its upward trend.

_______________

1Mexican manufacturing and maquiladora employment is generated by the Instituto Nacional de Estadística y Geografiía. Its release typically lags the Texas Border Economy by one month.

[divide icon_position=”left” width=”short” color=”#”]

This story originally published by the Real Estate Center at Texas A&M University