Texas Border Economy: January 2018

![]() Despite this month’s economic slowdown, both residential and nonresidential construction values accelerated, and trade activity increased…

Despite this month’s economic slowdown, both residential and nonresidential construction values accelerated, and trade activity increased…

James P. Gaines, Luis Torres, Wesley Miller, and Bailey Cuadra

Weak employment growth and stagnant wages hindered economic growth along the Texas-Mexico border. Border housing sales contracted as sluggish earnings heightened affordability constraints. Despite this month’s economic slowdown, both residential and nonresidential construction values accelerated, and trade activity increased.

Growth in the national and state economies should bolster the border region, although several challenges lie ahead. NAFTA renegotiations, a slowing Mexican economy, and immigration reform uncertainty present the largest headwinds to Texas border metros in 2018.

Economy

Economic activity stagnated along the border, dragging down the Dallas Fed’s Business-Cycle Indices after they gained traction late last year. The Brownsville index contracted 2.9 percent annualized quarter over quarter (QOQ) as job losses extended the local economic downturn. Laredo and McAllen posted zero growth despite a tightening labor market. El Paso remained the exception, maintaining steady growth at 1 percent as the business-cycle advanced in Texas’ largest border metro.

Construction activity contrasted the sluggish business-cycle indices. Hotel construction in Downtown El Paso and investment in McAllen apartments boosted total border construction values 23.3 percent. New schools in Brownsville and Laredo lifted their aggregate construction values 18.6 and 37.6 percent, respectively. Single-family construction also picked up along the border, increasing in every metro but Laredo.

Border employment increased marginally at 1.2 percent annualized QOQ, adding just 1,500 jobs1. Declines in trade, transportation, and government services plagued the Brownsville labor force, pulling QOQ annualized growth to –1.9 percent, its lowest since the Great Recession. An uptick in professional and business services lifted Laredo employment into positive territory for the first time in four months. El Paso strung together its sixth consecutive monthly job increase but added only 400 jobs since December. McAllen posted the largest increase with 700 new jobs, stemming from widespread growth in the service sector.

Labor market woes continued on the southern side of the border. Mexican manufacturing and maquiladora employment shed 9,100 jobs, primarily from contractions in Chihuahua City. Reynosa was the only Mexican border metro to increase employment, extending a 23-month streak of job creation.

Unemployment rates1 along the border remained historically low, led by Laredo at 3.7 percent. El Paso’s workforce expansion held the local rate slightly higher at 4.3 percent. The unemployment rate inched up to 6.3 and 6.9 percent in Brownsville and McAllen, respectively, but were well below year-ago levels.

Despite relatively low unemployment, real private hourly earnings suffered in the border metros. The wage crash continued in Laredo, dropping 8.9 percent year over year (YOY) with few signs of slowing. Brownsville wages trended downward after stabilizing in the second half of 2017, falling further below other metros. On the other hand, earnings ticked up slightly in El Paso and McAllen but remained about 27 percent below the Texas average.

The peso per dollar exchange rate1 hovered around 18.91, dropping 11.6 percent YOY as the U.S. dollar weakened. Favorable currency movements pushed the total value of border trade activity up 3 percent, driven primarily by export growth. Export values boomed 8.6 percent in El Paso after lagging throughout most of 2017. Laredo generated over 62 percent of total trade values across the border metros amid record high imports. Trade activity accelerated in McAllen and should continue amid infrastructure improvements on to the Mexican side of the Pharr International Bridge. Total trade values were stable in Brownsville, but imports fell for the second straight month.

Housing

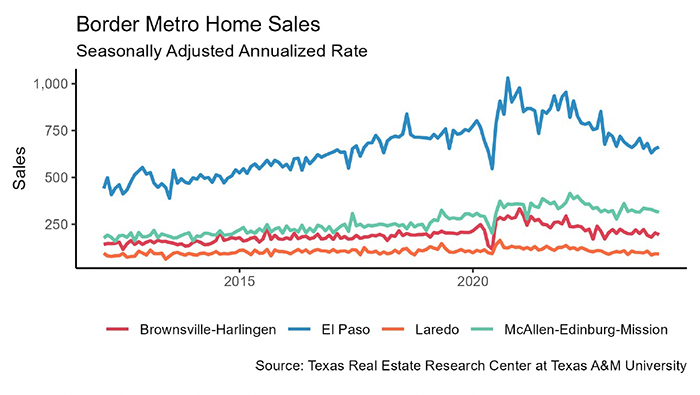

Border housing sales started the year slowly, dropping 1.2 percent. Sales trended downward in the smaller markets of Brownsville and Laredo, falling 1.9 and 1.0 percent, respectively. Sales in El Paso ticked downward 1.3 percent, but market fundamentals remained stable. McAllen was the exception, posting 2.3 percent sales growth amid solid job growth.

On the supply side, single-family housing construction permits increased 3.8 percent in the border metros. Momentum continued from 4Q17, lifting Brownsville and McAllen permits up 10.5 and 6.0 percent, respectively. Softer new home demand in El Paso and Laredo failed to slow single-family permit growth. Despite progress late last year, permits remained well below pre-recessionary levels throughout the border metros.

Upward trending permits supported increased private single-family construction values, primarily from a stabilization in El Paso and McAllen. Single-family construction values surpassed 10 percent growth in Brownsville despite sliding wages and employment. In contrast, values in Laredo sunk to their lowest level in over a year as economic activity remained suppressed.

The supply of homes for sale varied along the border but held above the statewide level. The total months of inventory (MOI) in El Paso and Laredo settled around 5.3 months but exhibited opposite trends. El Paso inventories extended a steady decline since its 2014 peak above eight months, while Laredo inventories increased for the seventh time in eight months. Surpluses persisted in Brownsville and McAllen with 9.3 and 8.9 MOI, respectively, but downward pressure was evident.

The MOI normalized for border homes priced between $100,000 and $200,000. This price cohort accounts for the highest proportion of housing activity and provides a clearer picture of supply conditions than aggregate levels. In Brownsville and McAllen, the MOI for this cohort flattened around 6.1 months, while falling to 5.4 and 4.1 months in El Paso and Laredo, respectively.

On the demand side, Laredo maintained the lowest average number of days on market (DOM) slightly over two months. The DOM dropped for the eighth consecutive month in El Paso but remained above 90 days. In McAllen, the DOM inched down to 97 days, while homes average more than four months on the Brownsville market.

Despite housing surpluses and weaker demand in Brownsville, both the MOI and DOM trended downward, lifting the median sale price $4,650 since June 2017 to $148,665. The median price was highest in El Paso at $190,373, followed by Laredo at $163,334. McAllen lagged the other border metros with a median of $136,435 but home values could appreciate as the labor force expansion continues.

_______________

1 Monthly numbers are reported instead of a three-month moving average for consistency.

This story originally published by Real Center Center, a publication b y Texas A&M.