Texas Comptroller Reports San Marcos City Debt At Over $314 Million

David LeDoux

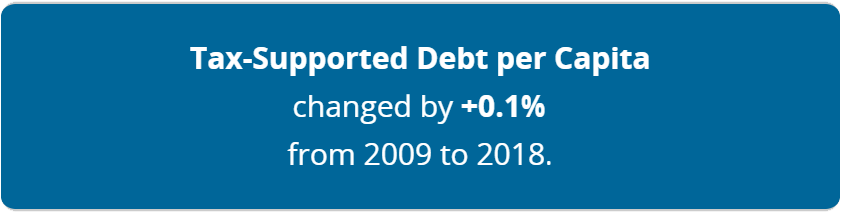

SAN MARCOS – San Marcos’ total debt equals $4,994 for every man, woman, and child who lives in San Marcos as of August 2018 and not one resident spoke at the first public hearing for the upcoming budget.

On Tuesday, the San Marcos City Council will hold the final reading and vote to finalize your property tax rate and their FY 2021 budget.

On September 1, the council held the first of two public hearings that would have allowed residents to say how much your new tax rate will be, spending in the coming year, and how much they are in debt.

Not one resident of San Marcos spoke for or against the proposed budget.

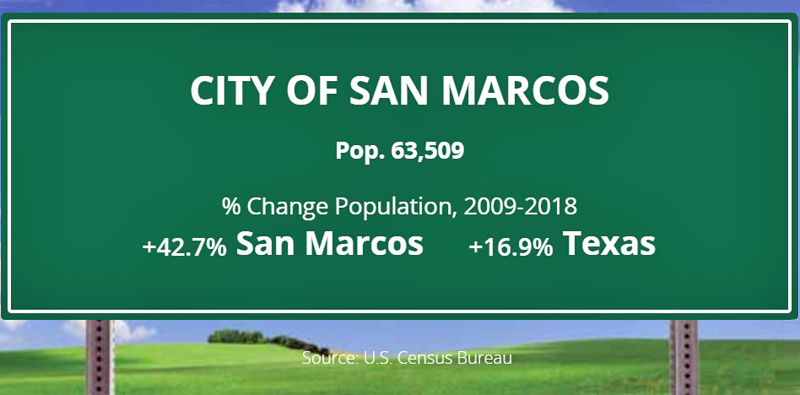

THE CITY OF SAN MARCOS

DEBT AT A GLANCE AS OF AUGUST 31, 2018

.

San Marcos was home to 63,509 Texans in 2018.

Its residents had a median income of $34,748 in 2016. The data on this page is provided as of the date indicated and may not reflect debt, population, or other data as of any subsequent date.

In addition, the debt is shown for the city only, and not for other political subdivisions that may have outstanding debt, taxing powers, and the same boundaries as the city.

![]()

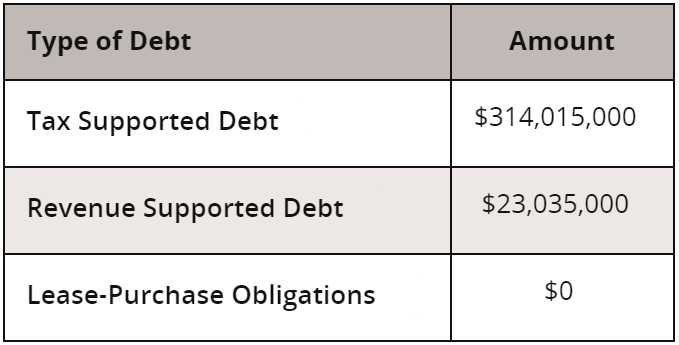

Current Debt Obligations

Debt Outstanding San Marcos, Texas as of August 31, 2018

What’s this?

- Debt Outstanding is the principal owed over the remaining life of all debt issues.

.

.

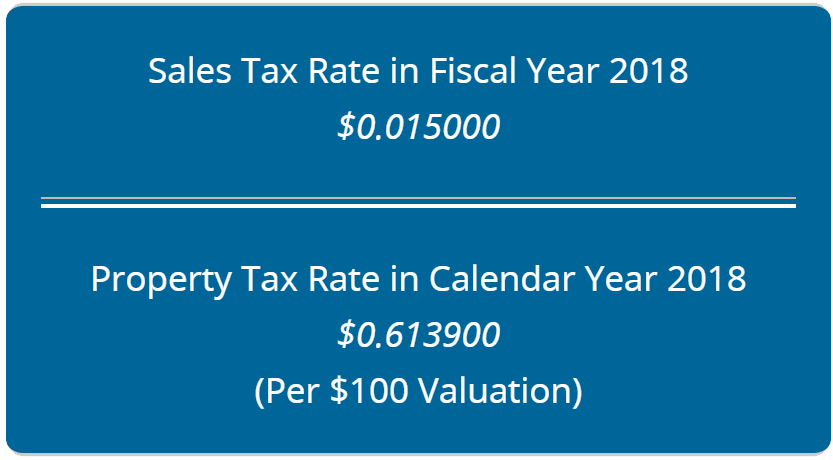

Tax Rates

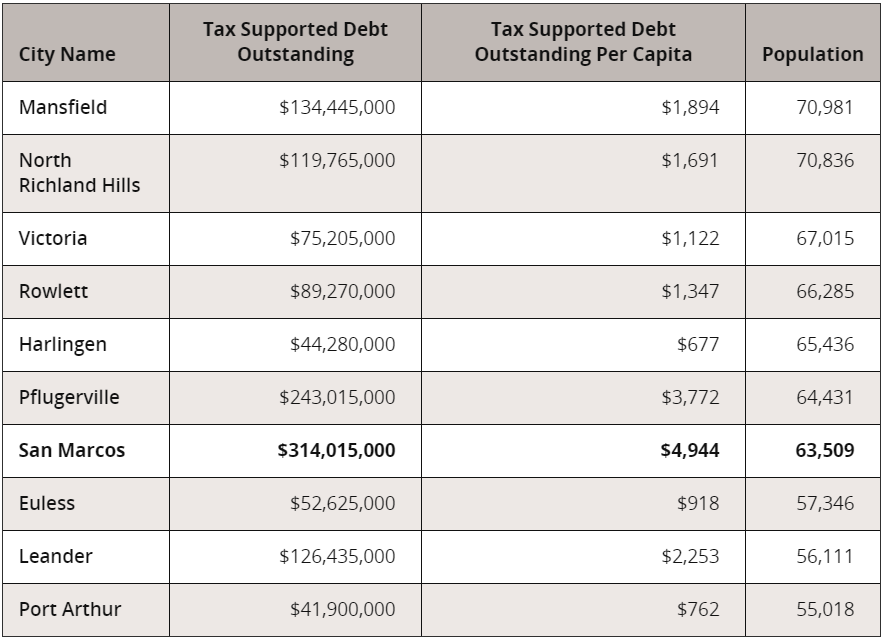

How San Marcos Compares

Tax-Supported Debt Outstanding for Cities of Similar Size As San Marcos, as of August 31, 2018

Note: The table includes San Marcos and nine cities with the closest population numbers based on the 2018 U.S. Census Bureau population data. Tax-supported debt does not include revenue debt and lease-purchase obligations. For cities with municipal gas and/or electric utilities, regional airports, or other capital assets not common to cities generally, Tax-Supported Outstanding Debt may include debt for infrastructure that in other cities is carried by private enterprises, a public facility corporation, or not at all.

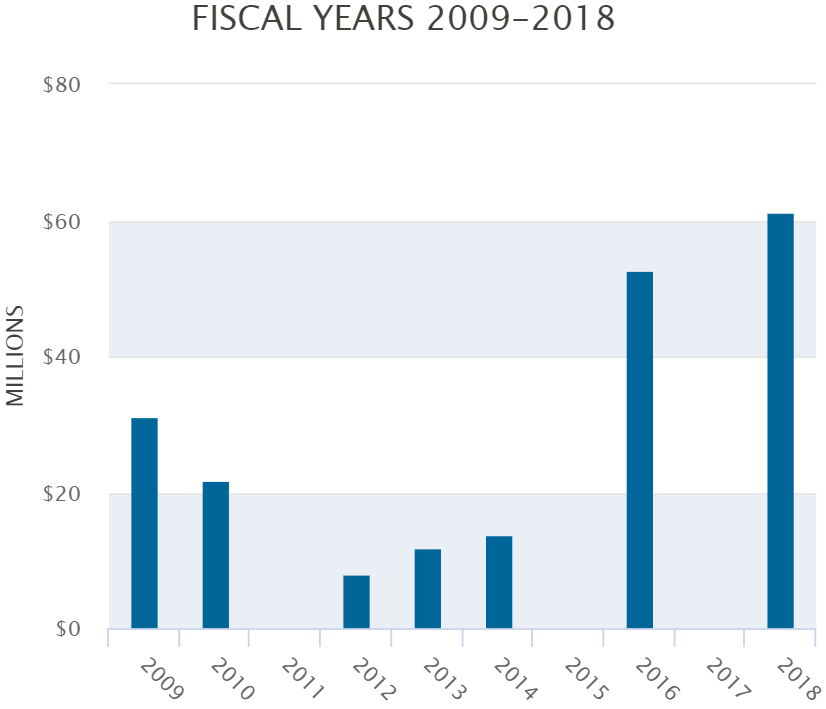

Certificates Of Obligation Issuances

What’s this?

Certificates of Obligation (COs) allow certain cities, counties, and hospitals or health districts to issue debt without voter approval (unless a referendum is petitioned) and are backed by tax revenue, fee revenues, or a combination of the two.

To learn more about the finances of public pension plans that may operate in this jurisdiction, please visit our public pension search tool.

Debt Trends

San Marcos Tax-Supported Debt Per Capita Outstanding at Fiscal Year End: 10-Year Trend

Note: Reflects debt in 2018 dollars divided by the estimated population in the relevant year. Some debt issued before 2008 may not be reflected.

An Introduction to Understanding Comprehensive Annual Financial Reports

When you’re ready to learn about a public entity’s fiscal health, you’ll find a great deal of information in comprehensive annual financial reports (CAFRs) and other yearly reports.

Often posted online alongside other financial information, CAFRs report an entity’s accounting statements, debts, and other key information for the past year.

But sometimes that information can be tricky to find – and tough to understand. Because of that, our office compiled some tips for locating an entity’s CAFRs and for understanding them.

You’ll learn how all CAFRs have certain similarities and when and why different entities’ CAFRs will differ in key ways.

Plus, we detail strategies for pinpointing the debt, expenditure, and revenue information you need to hold a government entity accountable.

Note that the data in the following publications is presented as of the dates indicated in the publications and may not reflect debt, population, or other data as of any subsequent date.

For further or more current information, see the applicable entity’s web site or its most recent filings at Electronic Municipal Market Access (EMMA®).

The Comptroller does not control or guarantee the accuracy, completeness, or currency of any such site. When you access any such site, you will be leaving the Comptroller’s website.

Read the Texas Comptroller’s Guide to Understanding Comprehensive Annual Reports (CAFRs).

Download Texas 2018 City Debt Comparison Data. (XLSX)

Download Texas 2018 City Debt Comparison Data. (XLSX)

![]()

Local Sales Tax Revenues and

How it Affects Your Property Taxes

In 1987, the voters authorized the city to collect an additional half-cent of sales tax that “is dedicated solely to the reduction of property taxes.”

According to the city, without the half-cent sales tax dedicated to property tax reduction, the city’s ad valorem tax rate would have to be 23.52 cents more, or 84.91 cents per $100 of assessed value, to support the programs and services provided to San Marcos residents.

Sales tax revenues represent 44.4% of total General Fund revenue projected for the fiscal year 2020.

Sales tax receipts are the largest single revenue source supporting general governmental services in San Marcos. Consistent retail sales have kept this revenue stream steady for the past several years.

When comparing historical sales tax collections by segment, the percentage represented by retail collections has decreased while other segments have increased, indicating a small diversification in the sales taxes produced in the City.

It is important to note that sales tax revenues are a volatile funding source and are subject to shifts in local, state, and national economies.

Up 100%!

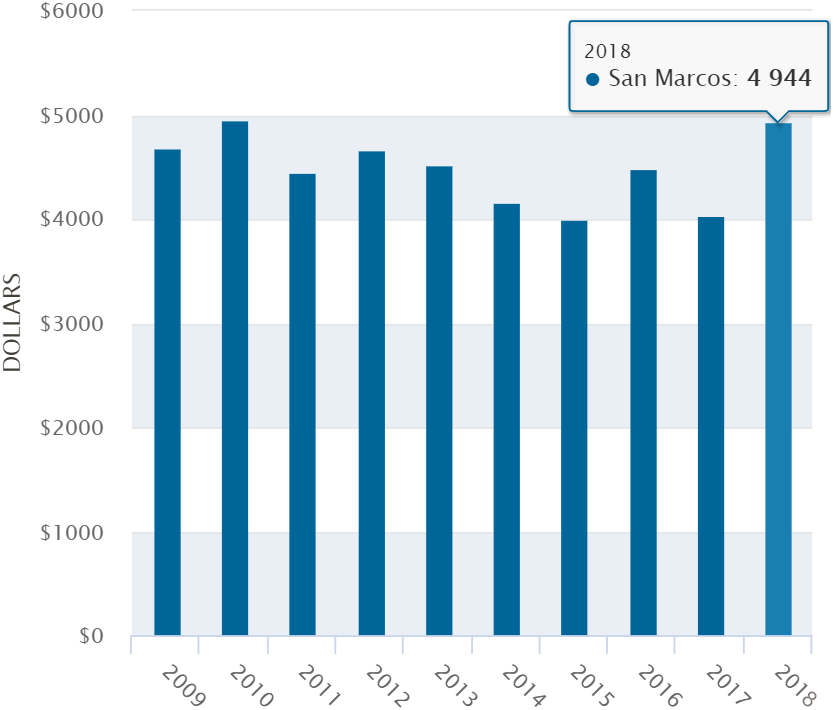

10-Year Appraisal Roll History For San Marcos Is Up Over 100%

(*per property & per tax year)

The FY 2020 budget forecasted to raise more total property taxes than last year’s budget by $3,609,774 OR 11.7 percent and of that amount $815,568 is tax revenue to be raised from new property added to the roll this year.

According to the current proposed FY 2021 Budget, it is forecasted “to raise more total property taxes than last year’s budget by $2,714,724 or 7.9%, and of that amount, $1,494,301 is tax revenue to be raised from new property added to the roll this year.”

![]()

Many THANKS for the well-written article.

Maybe you’ll be interested to know WHAT HAS HAPPENED to a certain 2.15-acre property in the 100 block of South Guadalupe Street between West San Antonio Street and West Martin Luther King Drive. Correct, the property which Gilbane Developments had envisioned for a 171-unit, 545-bedroom, student-purpose five-story structure, yet whose re-zoning attempt was denied due to immense community outcry.

First, understand our Governmental Ruling Elite was not happy about doing this to their big-money buddies, okay?

Accordingly, YOU, the community, have really done it now. And here’s your payback for having pi*ssed on the City’s campfire.

Because the City has now purchased that same property for itself (in its non-governmental proprietary capacity) and

THE CITY IS GOING TO BUILD A MULTI-STORY CONCRETE PARKING GARAGE THERE AND YOU CAN PAY TO PARK

Correct. After years and years of converting our downtown streets to parking lots on behalf of Texas State University, and after years and years of waiving off-street parking requirements to any new business within our downtown area, our Visionary Ruling Elite have now synthesized another partnership with fate, whereby YOU may participate in a meaningful way, as financial waterboys and watergirls.

You won’t be towed from the streets unless you get in the way. (And you will get in the way if your license plate is scanned by parking enforcement’s onboard OCR computer, and thereafter not “ignored” as a result of having a privileged status for unlimited parking on our downtown streets).

As a matter of fact, I DO know these employees, and they admit that due to the computer program, certain people get to park all day every day in stealth mode, while others “get the boot.” These guys hate how this allows some to monopolize on-street parking spaces at the cost of denying it to others, and that they and their jobs now consist as merely operatives for the Ruling Elite.

Oh, and be sure YOU don’t “get in the way” of that new 457-bed student-purposed housing development being built a couple of hundred feet away from the site of OUR new parking garage. You know, over on San Antonio Street where our Ruling Elite tore down the old San Marcos Phone Company, allegedly for purposes of a “166-bed multi-family apartments” known as the “San Marcos Lofts I & II”.

Well…that wasn’t true, okay?

What is true, is that this development which started out as 166-bed multifamily slated as the “San Marcos Loft I & II”, has been miraculously converted to a 457-bed student-purposed housing now called “The Parlor”, being yet another switcheroo accomplished by Chicago developer Jarred Shenck, who gave up getting things done the hard way, e.g.: the fiasco known as Hillside Ranch, and has now devoted himself to projects accomplished under the radar, by means of “consultants.”

Your Elite have been suffering you, and now they’ve had enough. So, either pay them to protect you safely off of the street, or get towed. (Gosh, maybe the Texas State Police can assist the tow away. Eat’em Up Cats!). Oh, and you potentially outraged erstwhile liberals should note, that despite your new fate as water persons for your Anointed Ones, your mermaid icons will not come to life nor save you, no matter how much you regret or deny having enabled San Marcos to become your new Austin.