Texas Manufacturing Expands Modestly, Outlook Worsens

![]() Texas factory activity continued to expand rather modestly in December, according to business executives responding to the Texas Manufacturing Outlook Survey…

Texas factory activity continued to expand rather modestly in December, according to business executives responding to the Texas Manufacturing Outlook Survey…

![]()

Texas factory activity continued to expand rather modestly in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, inched down one point to 7.3.

Other indexes of manufacturing activity also suggested modest growth in December, although demand growth picked up a bit. The capacity utilization index fell from 9.4 to 7.6, and the shipments index dipped to 6.1. Meanwhile, the new orders index moved up five points to 14.4, and the growth rate of new orders index edged up to 5.8.

Perceptions of broader business conditions turned slightly negative in December. The general business activity index plummeted 23 points to -5.1, hitting its lowest level since mid-2016. The company outlook index also fell markedly, dropping 17 points to -3.4, also a two-and-a-half-year low. More than 20 percent of manufacturers noted their outlook worsened this month.

Labor market measures suggested continued but slightly slower employment growth and longer workweeks in December. The employment index retreated five points to 11.0, a level still above average. Twenty-two percent of firms noted net hiring, compared with 11 percent noting net layoffs. The hours worked index held steady at 5.0.

Price increases eased further in December, while wage growth picked up slightly. The raw materials prices index slipped five points to 28.8, and the finished goods prices index ticked down one point to 6.6. Both came in near their average levels. Meanwhile, compensation costs continued to rise at a faster clip than normal. The wages and benefits index moved up four points to 29.2, with nearly 30 percent of firms noting an increase from November.

Expectations regarding future business conditions remained positive but retreated notably in December. The indexes of future general business activity and future company outlook fell 23 points to 3.2 and 8.8, respectively. Most other indexes for future manufacturing activity also posted double-digit declines this month but remained solidly in positive territory.

Manufacturing Special Questions

Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

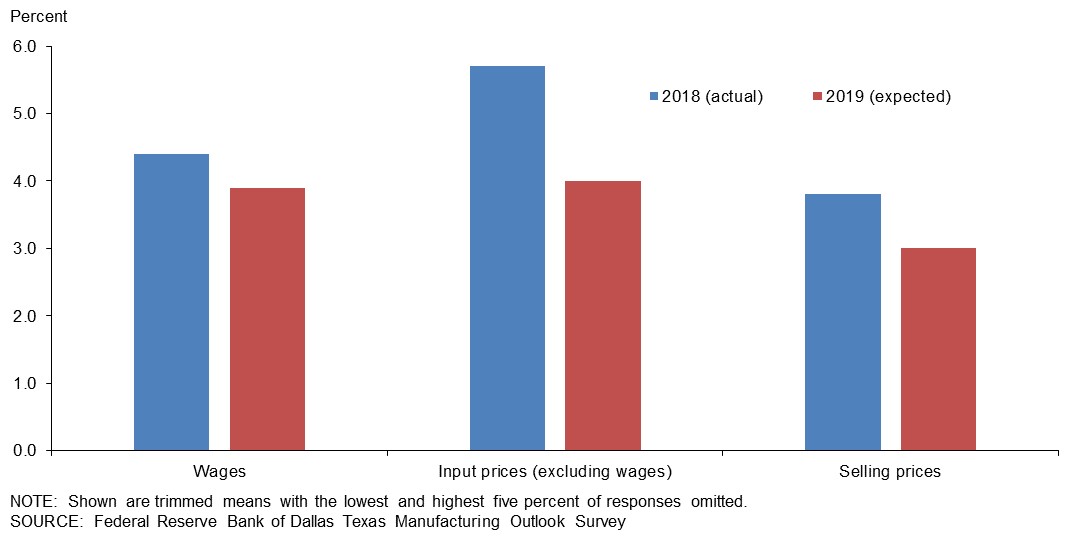

| 2018 actual (percent)* |

2019 expected (percent)* |

|

| Wages | 4.4 | 3.9 |

| Input costs (excluding wages) | 5.7 | 4.0 |

| Selling prices | 3.8 | 3.0 |

| Dec. ’18 (percent) |

||

| None | 17.2 | |

| Some | 50.5 | |

| Most | 23.2 | |

| All | 9.1 |

| Dec. ’18 (percent) |

||

| Much easier now | 1.0 | |

| Somewhat easier now | 26.5 | |

| Similar to six months ago | 35.7 | |

| Somewhat harder now | 20.4 | |

| Significantly harder now | 16.3 |

| Dec. ’18 (percent) |

||

| Increased substantially | 11.1 | |

| Increased slightly | 24.2 | |

| Remained the same | 17.2 | |

| Decreased slightly | 35.4 | |

| Decreased substantially | 12.1 |

*Shown are trimmed means with the lowest and highest 5 percent of responses omitted. A similar question was posed in May 2018 asking about wages and prices in 2017 (actual) and 2018 (expected).

Special Questions Comments

Food Manufacturing

- Cost decreases are per ton and are driven by volume and low commodity prices. The current crop is much smaller, and per-ton costs will be rising in the coming months.

- The increase in EBIT [earnings before interest and taxes] is a result of significant growth on the top line.

Apparel Manufacturing

- We are getting to be more efficient the longer we have military sewing projects.

Printing and Related Support Activities

- Increases in unit wage and raw material costs are primarily offset with increased productivity in this manufacturing business. Wage increases have not outpaced volume and production rate increases.

Fabricated Metal Product Manufacturing

- Some utility companies understand and will accept some price increases due to steel price and shipping cost increases. However, some large privately funded and federal jobs are now sourcing their steel structures from foreign sources, causing us to be price uncompetitive.

- There is strong competition for the work that we do. Margins have continued to narrow due to excess capacity and firms willing to bid work at or below costs to maintain production capacity.

- Operating margin has increased, primarily due to capital investments in manufacturing equipment. With these investments, we have improved efficiency while maintaining head count.

Computer and Electronic Product Manufacturing

- We had contraction in the latter half of 2018 and kept key employees in anticipation of expanding in 2019. We are starting to see significant expansion for 2019.

Electrical Equipment, Appliance and Component Manufacturing

- Our industry is finally realizing that you have to pass on cost increases in good times, and our improved profitability in the last 18 months is commendable. We did a salary survey of companies and found we were low on starting pay for our hourly workforce. Eighty-five percent of our people are hourly. We are making adjustments in January to be competitive and hopefully cut turnover and attract better candidates. Ten percent is a guess on the total impact to our wage rates.

Transportation Equipment Manufacturing

- Competition from India, China and South Korea has resulted in a substantial decrease of business for us. Although raw steel has tariffs on imports, the finished goods resulting from the raw materials do not. This has given our foreign competition a very unfair advantage over U.S. manufacturers.

- Our ability to pass increases in costs (including wages) along to customers is somewhat harder because new contracts and agreements require extended price guarantees for multiple years, with one exception. Increases in raw material costs remain easy to pass along. Operating margins have decreased slightly in the past six months because revenue declined unexpectedly while investment in personnel (additions and advanced training) increased in line with performance in the first half of 2018. However, this margin is a substantial increase from the previous year.

Source: Federal Reserve Bank of Dallas